August 12, 2020 | AtoZMarkets – What turns a good trading strategy into the best Forex trading strategy? Generally, an individual trader can call his strategy as the best trading strategy after modifying it to his own needs. Your personality will play a significant role in your trading success. Conversely, it is easier to personalize a proven trading strategy too. Therefore, you will need to experiment with various methods until you settle with one is required to discover the Forex trading strategies that work. Pick the best performing elements, remove noise creators, and build your very own trading strategy.

Types of Forex Trading Strategy

There are several types of trading strategies from short time-frames to long. Successful forex traders always remain aware of the different strategies in their search. Therefore, they can choose the right one based on the current situation.

- Scalping trading strategies are for those traders who love adrenalin. Most of the trades are held just for just a few minutes. A scalper can earn profit by beat the bid/offer spread. Having a tick chart is very useful for scalers. To have a tick chart you either need MetaTrader 4 Supreme Edition. You can also download the Custom Tick Chart Indicator for MT4 if you have a classic MT4.

- Day trading strategies - These are trades that traders open and close within the same day or trading session. That removes the chance of waiting overnight for the large moves. Day trading strategies are perfect for beginners. Trades may need only a few hours, and price bars be set to one or two minutes. There are several day trading forex strategies that may be suitable for newbies. This type of strategy is also the closest to Halal Forex Trading.

- Swing trading - Traders also call it the trend following trading strategies.

In swing trading, the Positions are held for several days. So, the traders are aiming to profit from short-term price patterns. A swing trader looks at the bars every half hour or hour.

- Positional trading - These are Long-term trend following. A long-term trader looks at the end of day charts. The best positional trading strategies require patience and discipline. It requires a good amount of knowledge about market fundamentals.

Why Do You Need a Trading Strategy?

Before discussing how to build the best forex strategy, we need to understand why we need a trading strategy. Additionally, you need to understand what makes one strategy better than others. There are two main reasons behind any forex trading strategy: hedging and speculation.

Speculation based trading strategy is to predict a move that a trading pair is likely to make. Any correct prediction about speculation greatly improves the trading results. However, keep in mind there is a difference between probability-based speculative trading strategy and gambling.

You will probably like every trader, start thinking that you will become a millionaire over the night. First, you will test scalping strategies. Then, you will see that you never make consistent results from scalping, and move to Free Forex Signals, day trading and test a bunch of indicators and trading tools. Only then you will either build your successful strategy or fail and join the 95% traders that never made any money in Forex trading.

The Best Forex Trading Strategy

How do you call a trading strategy the best? Or in another way, what makes one strategy stand over the other one?

Forex traders may choose any of the automatic or manual trading strategies.

- Manual systems involve a trader sitting in front of a computer screen, analyzing for trading opportunities.

- Automated systems involve a trader developing an algorithm that finds suitable trading signals.

Traders should exercise caution when using forex trading strategies. However, it is difficult to verify the track record of many successful trading systems as they are kept secret.

Pick a Best Trading Strategy

There are lots of trading strategies available online and on the AtoZMarkets trading tools directory. Many trainers are selling their strategy as well.

If you are a student or a full-time worker, you will not have enough time for day trading. In that case, the long term swing trading will be the best option for you. On the other hand, if you got enough experience, you can choose scalping or day trading as an option. Some of the traders use price action trading strategy, and some of the indicator based.

However, some traders are like naked charts for trading. Therefore, you should know the basics of all types of trading systems to find the suitable one for you.

Match the Strategy With Trading Psychology

In forex trading, trading psychology is a big part of earning a profit. If a trader fails to match the trading psychology with the trading strategy, he cannot make profits.

Most of the analysts believe that the success from the forex market depends on the trading psychology more than 90%. In scalping, there is a possibility of hitting the stop-loss is much higher than the swing trading. For newbies, it is hard to handle stress like scalpers, so they are recommended to use swing trading only.

If you are not familiar with four stages, every trader passes through. You better familiarise yourself.

The only way to improve the trading psychology is understanding trading strategy well along with some meditation. You should keep your mind free from any bias before entering any trade. On the other hand, your personal life's pressure may affect your trading decisions.

Risk-Reward Ratio of the Strategy

There are many trading strategies with good track records but have a bad risk-reward ratio. It is not wise to take the risk of 100 pips to make a profit of 20 pips.

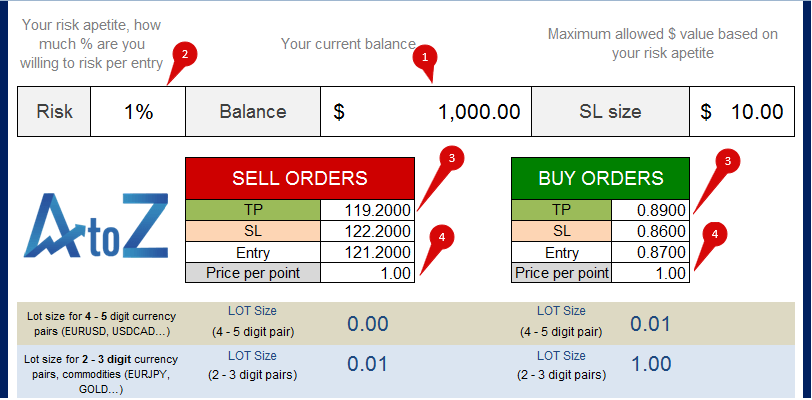

Sound risk-reward in the forex industry is a maximum of 1%-2% risk per trade, with a minimum 1.5 times return goal. However, the standard of risk-reward is to use a 2% risk per trade. Therefore, the lot size should be changed by risk. You can choose an indicator-based strategy or price action based strategy. But you have to make sure to follow a proper risk-reward on every trade. However, there is no fixed method about the risk-reward ratio, but you have to make your own. If you find a good trade setup with bad risk-reward, just leave it. The market is always running, and there will be more opportunities.

Money Management Is the Key

Before choosing a trading strategy, you should learn money management. Don't try to trade with a too-small investment. It will force you to use a broken money management style. You can download lot calculator to avoid money management mistakes.

Attention: Some brokers don't offer negative balance protection. So, always know your limit and never invest more than you can afford to lose.

Backtesting of the Strategy

Only choose the strategies that have a good track record. Your trading strategy may work well for the impulsive trend but might not work well in a volatile market environment. You have to choose the strategy that has a proven track record in all types of market conditions.

Warning: don't follow traders on social media, who are showing a 100% return with 1-2 orders. They are fake!

However, getting the track record is quite hard for forex strategies as they are not available. Moreover, some people may not share the track-records of their personal tradings. In that case, at least check some months of your desired trading strategy before going full time. Worst case scenario you should manually backtest your strategy.

Include Market Context on the Strategy

Whatever the strategy you use, you should consider the market context. Some strategies may work well in an impulsive momentum but fail in a correction. However, an impulsive pressure may break the resistance or support levels. Therefore, the reversal strategy may not work well. On the other hand, in a volatile market structure, the reversal strategy works well. The same things happen in the indicator based strategy. Moreover, the market is always changing. Therefore, you should keep yourself up-to-date information about the market context.

Conclusion – How to Choose a Reliable Forex Trading Strategy

The following are the steps on how to choose a reliable forex trading strategy:

- Learn yourself first; what kind of trader are you?

- Explore your trading psychology;

- Test various strategies and backtest them;

- Pick the working indicators but avoid indicator cramp on your screen;

- Don't panic if a good strategy is not working well for you; not every trader is the same!

- Test the strategy with the demo but also with live accounts;

- Use proper Risk Reward ratio and money management strategy.

- You have got your best Forex trading strategy!

- Gradually, optimize your strategy, the market changes all the time!!

When considering a trading strategy, you should be useful to compare how much time investment is required. Moreover, the risk-reward ratio and the regularity of total trading opportunities are also important. All trading strategies differ from the trader. Matching trading personality with the appropriate strategy is the key to take the first step in the right direction.

Think we missed something? Let us know in the comments section below.

This article was updated by Samson Ononeme on August 12, 2020, and originally created on November 20, 2019.