Many traders have sent queries to AtoZ Markets' team with the MetaTrader crypto questions: what are crypto CFDs and how to trade cryptocurrency in MT4? MT4 crypto trading is, in fact, similar to forex trading. The concept also involves making profits from the difference in prices from the market volatility. In this crypto CFDs beginners guide, we will explain to you the crypto CFDs basics and how to trade cryptocurrency in MT4. Of course, we will mention the best mt4 cryptocurrency broker.

March 9, 2022, | AtoZ Markets – Cryptocurrencies have shaken up the world's financial markets. This innovative digital technology provides a new dimension in contrast to traditional currencies. Since cryptos allow a person to transact quick, unregulated, anonymous payments all over the world.

Bitcoin was created in 2009, and since its launch, the cryptocurrency trading hype has been picking up. Especially, after its all-time high with its a Cryptos are known for its price volatility and developments. At that time, it was not easy for traders to invest or trade in cryptocurrencies, as it is in today's market.

Physical Bitcoin Investments Vs. Bitcoin CFD Trading

Unlike traditional currencies, cryptocurrencies are different and totally decentralized. They use blockchain technology with various platforms for various uses. All of these factors make Bitcoin and other cryptos high-unpredictability instruments since their values fluctuate heavily on fundamentals, such as government releases, geopolitical tensions, security concerns, regulatory news, blockchain news, and many other factors.

Trade Cryptocurrencies safely with an AtoZ approved broker:

Before investing in BTCUSD MT4 or cryptos, it is important to understand the differences between physical cryptos investments and cryptos CFDs.

How to Invest in a Physical Bitcoin?

If you wish to purchase and store Bitcoins, the primary step is to create a wallet. This is often just about like opening a bank account for fiat currency. Opening a wallet can be done at crypto firms that offer wallets or crypto exchanges. You'll use the wallet to receive bitcoins, store them and transfer them to others.

Most people find it a bit confusing to purchase physical bitcoins and to protect their wallets. Moreover, this is often not suitable for traders who are used to margin trading like in the FX or CFDs market. Since buying and selling cryptos on crypto exchanges is not easy as with a trading platform in FX.

Pros of Investing in Physical Cryptos

- Purchase of altcoins

- Using Crypto Exchanges to make trades

- Purchase of fewer know cryptos

- Individual ownership of the Cryptos

- Simple international trade to other accounts

- Make payments in cryptos

Cons of Investing in Physical Cryptos

- Traders lack charting tools to analyze and trade a crypto

- Risks of Crypto Exchange hacks

- Risks of losing the wallet

- Many wallet providers now charge money to prioritize confirmations from vendors

- Unclear tax regulations when withdrawing large sums

What is Cryptocurrency CFD Trading?

A CFD (Contracts for Difference) is where a buyer and a seller agree to pay in cash any difference in prices because the value of the cryptocurrency rises or falls, rather than buying the underlying asset itself. So, there's no typical “buyer” and “seller” in such a contract. If the trend is accurately predicted, you'll get paid the difference within the value of the cryptocurrency. If not, you'll find yourself paying the difference to the opposite party.

You don't have to invest in cryptocurrency assets by trading Cryptocurrency CFDs. You can also make an assessment of the direction that the price might go. There is no need to be concerned about insecurity. CFD trading also allows traders to set stop-loss and profit levels. This is especially useful considering how volatile cryptocurrency can be. CFD trading has other benefits.

Pros of Trading Cryptocurrency CFDs

- No need for a crypto wallet or exchange, meaningless risks

- Funds in the account are segregated and some brokers are part of the Investors Scheme Fund

- Traders can cut losses in any uncertain situation with stop loss and risk management

- As a trader of cryptocurrency CFDs, you've got access to charts and tools of study to assist you in creating decisions

- MT4 charting tools helps a trader to make a better analysis of crypto CFDs

- Professional support from brokers in different languages

Cons of Trading Crypto CFDs

- A limited selection of cryptos to trade

- Not possible to trade altcoins

- Not possible to trade less popular cryptos

- No ownership of the actual crypto

How to Start Trading Cryptocurrency in MT4?

You can trade BTCUSD MT4 CFDs and other cryptocurrency CFDs on the forex industry’s most popular online trading platforms; MT4 and MT5. Many forex brokers support both desktop and device-compliant versions, plus WebTrader for trading via your browser.

You will need to open an account first with a reliable Forex broker, fund the account, and then start trading with real money. MT4 and MT5 have powerful charting tools to assist you in making trading decisions.

This walk-through will teach you how to trade cryptocurrency in MT4. Why MT4 is so popular? It is the most widely used and popular trading platform in the Forex market. Follow the steps below to get started in the Crypto CFDs Market.

- First, you need to locate a trustworthy MT4 cryptocurrency broker who offers Cryptocurrency trading. Many forex brokers now allow Cryptocurrency trading. However, it is important to find a broker that permits CFDs trading.

- You can open a demo account or live account with your preferred regulated MT4 crypto broker. Then, download the MT4 platform by following the link in your email.

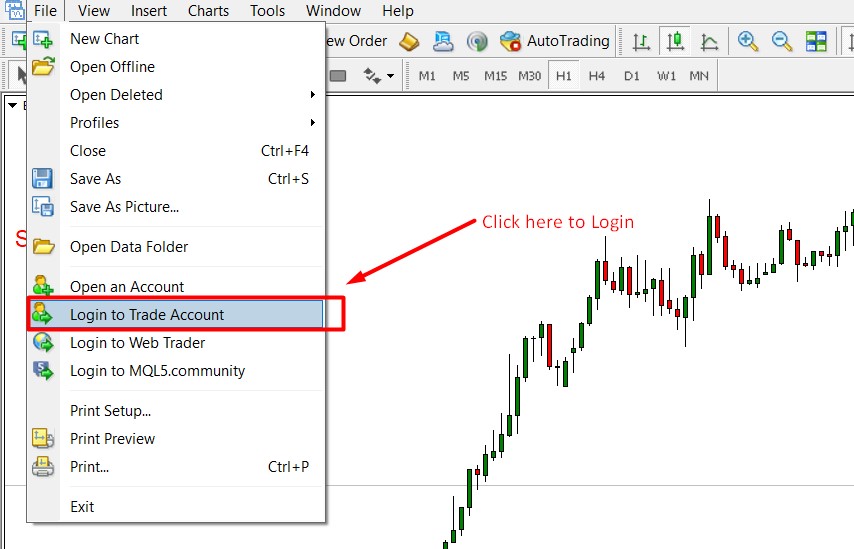

- Log in to your account via the MT4 platform using the information provided by your broker.

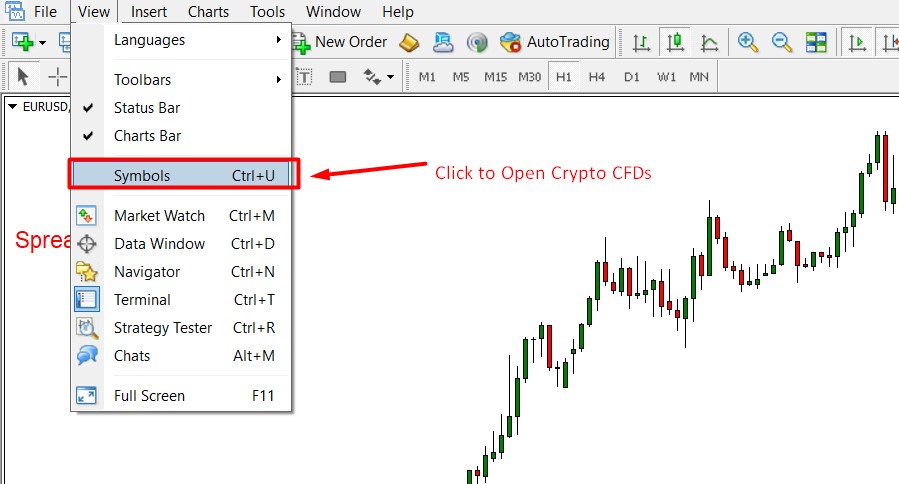

- Then click “View” and then “Symbols” from the top navigation window, or simply press Ctrl + U on your computer. This will show the Crypto CFDs which are listed on the platform.

- To open the complete list of cryptocurrency, click on the + sign next to 'Crypto. Click on "Crypto", to view all cryptocurrencies. Click on "show" and they will all be displayed in the Market Watch window.

Best Forex Brokers for Cryptocurrency Trading

We have prepared a rating that will allow you to use the best MT4 crypto brokers for trading bitcoins. Since 2017, it became possible to trade Bitcoin on MT4. Due to the high volatility, trading this cryptocurrency pair is becoming an extremely attractive tool for traders.

There are not so many really reliable cryptocurrency MT4 brokers that support full-fledged work with BTCUSD MT4. Therefore, this section contains only the most famous MT4 crypto brokers that offer work with the BTCUSD MT4.

Some of these top 5 brokers don't accept customers from certain regions. So the alternative top 3 list below here will automatically show you the best alternative brokers that accept customers from your region:

1. eToro

eToro is another Isreal based Bitcoin CFD broker organization working in this position for over ten years. Besides, they know everything about this game boasts of having five million or more clients.

In any case, this crypto broker doesn't serve US clients because of administrative obstructions. However, if you are from any other nation that needs to begin with Bitcoin CFD trading, eToro is the best approach. You can exchange here utilizing your money, which can be immediately deposited utilizing your Mastercard, PayPal, ACH, or wire transfers.

2. Markets.com

Markets.com is a global broker that offers low spreads, a diverse range of CFDs and the best trading platforms available. Regardless of your level of experience, the broker offers an appropriate trading platform (MT4, MT5, Marketsx or Marketsi) with tools to help you develop trading strategies with over 2,200 CFDs to choose from.

As the broker is a market maker and uses a dealing desk when executing orders, all foreign exchange spreads are commission-free and competitive when compared to other top forex brokers.

3. OctaFX

Brokerage company OctaFX is an international MT4 cryptocurrency broker. Created in 2011, OctaFX is headquartered in London, UK. Forex broker OctaFX has an SVG license and operates in accordance with the requirements of this regulator. The broker's reliability is recognized in many countries of the world, as evidenced by the prevailing positive feedback on various thematic forums dedicated to online trading in the international currency markets.

4. Forex4you

Forex4you is a structural unit of the international financial and investment group E-Global Trade & Finance Group, Inc. The broker was created in 2007 for traders who primarily value a progressive approach to the process of trading currencies. Forex4you is one of the best MT4 crypto brokers and the firm is officially registered in the British Virgin Islands and is regulated by the FSC. This broker has offices in such countries as India, Great Britain, and Malaysia.

The rating of Forex4you among competitors is quite high due to the range of account types offered by the company, which makes it possible to choose the most optimal trading conditions.

5. HotForex

HotForex is an award-winning STP commodity and forex broker that provides services and trading tools to both private and institutional clients. This broker is preferred by traders from all over the world as it adheres to the policy of providing the best trading conditions to its clients and allows both small-value speculators and traders using expert advisors to have unlimited access to their liquidity.

HF Markets Europe Ltd., which operates under the HotForex trademark, is authorized by the Cyprus Securities and Exchange Commission (CySec) and is regulated by that authority. In addition, the company has an international license (No. 183/12), according to which the company is granted the right to provide investment services around the world.

Conclusion

The choice is entirely up to you, to invest either in a psychical Bitcoin or trade cryptos CFDs. Cryptocurrency CFD trading is perfect for traders who have knowledge about Forex, stocks, indices, and CFD trading through MT4. Additionally, you can make use of your favorite technical tools and indicators to trade Cryptocurrencies through MT4.

Since crypto CFDs trading is quite similar to forex trading, you've got to start first with proper training. Aside from the trading practices, you need to also learn about risk management and money management. In terms of trading strategies, there are many trading strategies available online. You only need to choose one among them that suits you most and start practicing!

Should you trade cryptocurrencies on your own at all?

This article will help you understand the basics of cryptocurrency trading before you begin.

Dr Yury is a PhD in Economics and our in-house trade expert. He will give you his top forex and cryptocurrencies daily to buy or sell.

Since 2015, his trading strategies that are based on nonlinear dynamic models have earned more than 65 000 pip profits. There are strong buy signals in several markets right now that you shouldn't miss.

Want to see which ones?