AtoZ Markets - Mean Reversion is a strategy that is followed by many professional traders and hedge funds. When a market starts trending on the long or short side, it drags investors to ride against the rush.

Furthermore, when a good amount of investors have joined the opposite side, the market reverts back to a restrainable level.

What is Mean Reversion?

Mean Reversion theory is simple which is used by finance. When an asset price reverts back to the long-term mean or average level of the total dataset is called Mean Reversion. That means investors can rely on other related averages, such as financial growth or the monetary level of the industry.

This Mean Reversion theory led many investing strategies that include buy or sell of an asset whose recent performance has fluctuated mightily from their historical averages.

Moreover, it also indicates that the asset or the institution has no longer has the same expectancy as before. In this case, there is a high probability that the mean reversion would occur. Furthermore, Mean Reversion base on the mathematical theory of trading and investing by professional traders, who can move the market for a while.

How to Use Mean Reversion?

Mean Reversion is a technical analysis of the market. Which also can be used as a part of the trading strategy. This theory mostly used to the idea of buying at the bottom and selling at the top.

Moreover, Mean Reversion has been used to understand the volatility of the market and also how the asset is going to move around with a long-term level.

Mean Reversion tries to elaborate on the ultimate changes in the market price. Predict that the price will revert back to the average level. This theory can be used for both the buying and selling market. It allows a trader to make a profit on certain upswing and to save on unusual lows.

In addition to this, there is no guarantee that the price always revert back to a normal pattern. So unexpected inconsistency could imply a change in the market pattern.

These events may include, still aren't limited to new product launching or upliftment on the positives side, or retract on the negative side.

Even in the utmost event, an asset could penetrate in a mean reversion. However, there are few sureties about how certain events will affect or won't affect the entire appeal of particular securities with the most market activity.

Want to trade Forex with a regulated broker? Open a free account with AtoZ Markets approved forex brokers:

Trend Riding vs. Mean Reversion

Commonly, by breakouts trend riding happens whereas mean reversion is a stretched moving average that you can hope to go backward. Combining both strategies can lead to a near 80% win rate, according to the study. Using both technical and fundamental info for trading in stocks have found profitable.

In the stock market, combining trend riding with Mean Reversion trading can befit a strong trading strategy. Moreover, you are using one method only to find trading opportunities in Trend Riding vs. Mean Reversion. So combining both methods can benefit to raise the chance of winning.

Mean Reversion Strategies

90/30 MA Mean Reversion Strategy

When a stable trend in the price of an asset and the price ups and down randomly around this trend. Then Mean Reversion strategies work on the prediction. So, values detached away from the trend will avail reverse direction and return to the trend.

That means if the value rarely goes high, we hope it to go back down or if the value rarely goes low, it will go back up. The essential part of this strategy is to identify the underlying trend. Have a look at the image below:

We calculate the 90-day Moving Average (90d MA) as a stable trend of an asset. We also calculate the 30-day Moving Average (30d MA) and see how it fluctuates around the 90d trend. Moreover, when 30d Moving Average drops below 90d Moving Average, we can hope the price will revert back to the 90d line.

Want to trade this strategy with a regulated broker? Open a live account with AtoZ Markets approved forex brokers:

It indicates the current price is too low and likely to rise, which a signal to take buy. Besides, when 30d Moving Average crosses above 90d Moving Average, we can hope the price will fall back to the 90d line. It indicates the current price is too high and likely to fall, which is a signal to take sell.

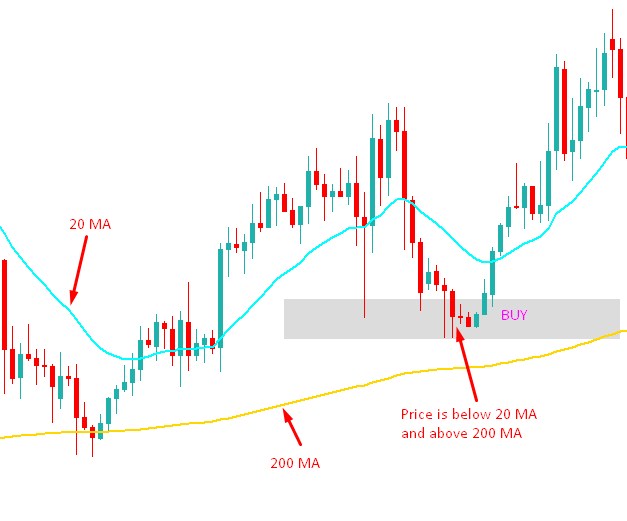

200 MA/ 20 MA Mean Reversion Strategy

In this trading strategy, we're going to use 200-period Moving Average and 20-period Moving Average. This strategy based on a simple method:

- But when the price below 20 MA and above 200 MA

- Sell when the price above 20 MA and above 200 MA

Buy Entry:

Buy Entry:

In the uptrend, look for buy entry when the price comes below 20 MA and closes above 200 MA. Besides, if the price shows any sign of impulsive bullish pressure and has a bullish close in that particular timeframe, go for the buy. Your stop loss should be below 200 MA and take profit should be at the recent resistance level.

Sell Entry:

In the above image, you can see the price climb above 200 MA, as well as 20 MA. Moreover, the price also made a double top which indicates the price is overbought at that level. So, if the price shows any sign of impulsive bearish pressure and has a bearish close in that particular timeframe, go for selling. Your stop loss should be above the bearish candle with buffering and take profit should be at the recent support.

Price Change Strategy

When the stock moves up by 10% for two days and it took six days to retrace 5% or 6%. That means divergence in this trend is working strongly. However, you can't use this strategy in every asset of the market. You have to backtest this method on the particular stock to understand the behaviour. Moreover, this strategy is very profitable as most traders are using it with an indicator and candlestick pattern.

Most traders use this strategy to ride the trend. Still, occasionally the Mean Reversion strategies merge with the velocity of price momentum. For instance, if the price of the stock's average movement is $1 up or down, then the day price of the stock fall by $5. The investors will expect that the price will move up in the coming days. So, in this trading strategy, you just have to look at the price movement without using any indicators.

Conclusion

Many traders use the Mean Reversion strategy in numerous ways. Some of them use only (20, 50, 100, 200) MA revert back strategy or some use MA cross over strategy. All you have to know the basic theory of the Mean Reversion strategy so that you can use the theory to find out a strategy, which fits your trading psychology and market situation.

Thus, you can push your opportunity to gain more winning trades. Although knowing the theory of Mean Reversion is the primary thing, still you need to practice more and more to master it. We hope you enjoyed reading this article. In the future, we will be updating the other strategies as well.

Should you trade with Mean Reversion Strategies on your own at all?

Before you start trading with these strategies, you'll want to read this.

Our in-house trading expert Dr Yury Safronau, PhD in Economic Sciences, gives you daily his best forex, metals, and cryptocurrencies to buy and sell signals right now.

His trading strategies which are based on non-linear dynamic models have achieved more than 65 000 pips of profits since 2015. And right now there are some very strong buy and sell signals across several markets you don't want to miss.

Want to see which ones?

Buy Entry:

Buy Entry: