Stock backtesting is very important for traders before implementing a strategy with real money. As we know, in the forex and stock market there are many trading strategies, but identifying an effective one is the key.

There is no way to determine the effectiveness of the available trading strategies until you implement it on your chart. There are many tools to backtest a trading strategy, and tradingview is one of them. In the whole section, we will see what the tradingview is and how you can backtest stock strategies with tradingview.

Can't wait to start using tradingview?

Stock back-testing allows us to know how much gain a trading strategy will provide, including the risk: reward, drawdown, and winning percentage. there are lots of backtesting software available on the internet but identifying the effective one is very challenging.

Why is stock backtesting software important?

It is quite impossible for a person to test several trading strategies at a time, as it requires a lot of time and effort. Therefore, spending a year or two to trading strategies in a real chart does not make any sense.

Can we test the performance of a trading strategy for the last five years in just 5 hours?

Yes. Backtesting software allows you to do this. Therefore, you will get enough time to make a profit rather than just testing it.

In early 1980, people used to backtest trading strategies by using paper and pen. Later on, in the 1990s, with the introduction of Computer monitors people were able to backtest in a digital formation. Following the path, in the present world, tradingview becomes the most effective stock testing tool.

Before moving to the step by step approach of backtesting stock strategies using tradingview let's have a look at what the backtesting is.

What is Backtesting?

Backtesting is a process to check the performance of a trading strategy in the historical data. It is a vital tool for a trader's toolbox, without which they wouldn't even consider diving into the market. It is important to analyze the market before purchasing anything. Similarly, before implementing a trading strategy into the real chart, it is necessary to see how it works at different times and market conditions.

Try the stock backtesting strategy with a reputable broker on a free account:

Finding the right stock backtesting software is crucial for every new trader as it will save money and time. We have done an extensive analysis of stock backtesting software. Therefore, we will represent the trading view from the top 5 stock backtesting software in the following section.

Tradingview As a Backtesting Softwares

image credit: TradingView

There is a lot of backtesting software available on the internet. Some software is free to use but does not provide adequate capacity for backtesting. On the other hand, some software is paid and very useful.

Tradingview was launched in 2011. It is a secure and web-based platform for stock and forex backtesting. The real-time data and mostly accurate price charts make it possible to research the market from anywhere.

They have implemented backtesting effortlessly and intuitively.

Backtest Stock Strategies with Tradingview

In this section, we will see a step-by-step guide on how you can backtest stock trading strategies using the tradingview platform. If you can't wait, then start using Tradingview here today for stocks back testing:

Bar Replay

Bar reply is an option that allows you to move backward and see the market performance based on your trading strategy to determine how profitable it was. The best thing about this tool is that it is an integrated tradingview tool that is available to both free and premium users.

If you want to backtest a stock trading strategy, it is an excellent tool for the last 5 or 10 years as it provides information as much as it is available on the server. In most cases, the Tradingview server is enriched with a lot of historical data that might not disappoint you

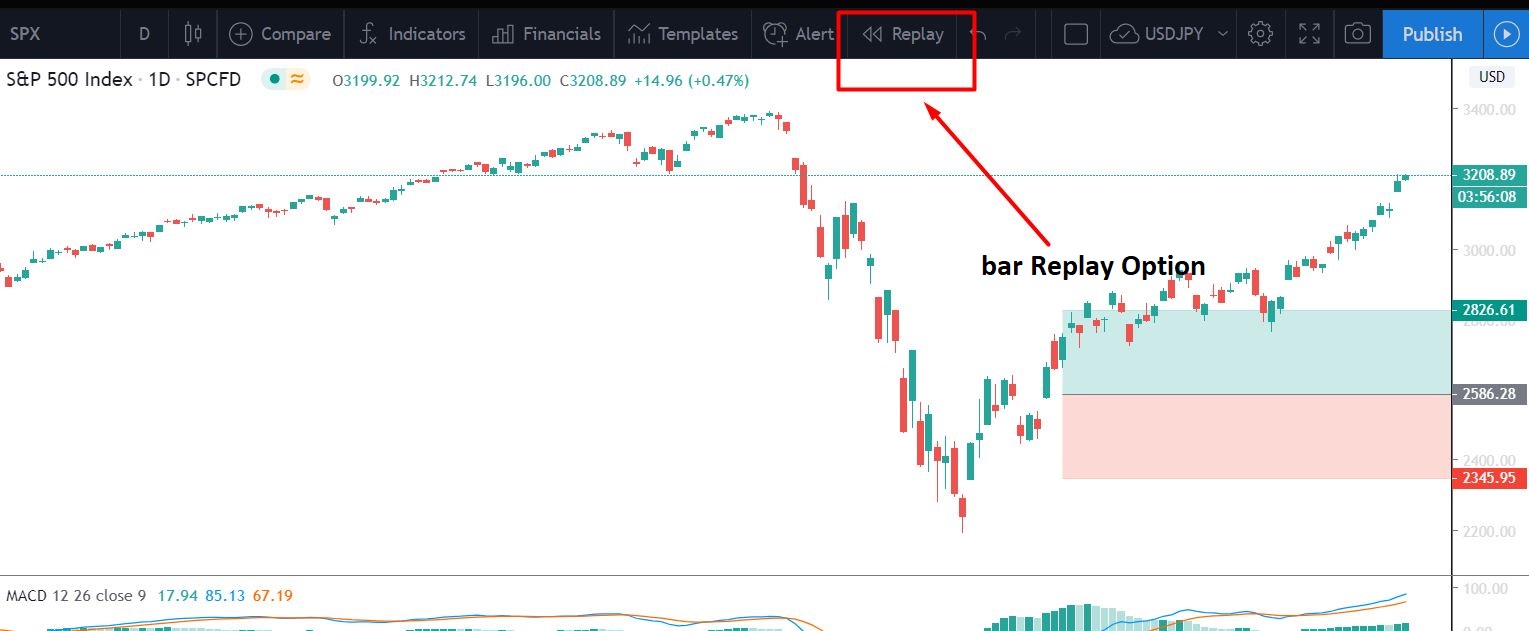

If you want to turn the reply on, you have to click on the toolbar that is available at the corner of the screen.

Adjust Bar Replay Settings

As you know, there are several trading strategies and instruments available in the market, you need to find one and implement on the tradingview chart.

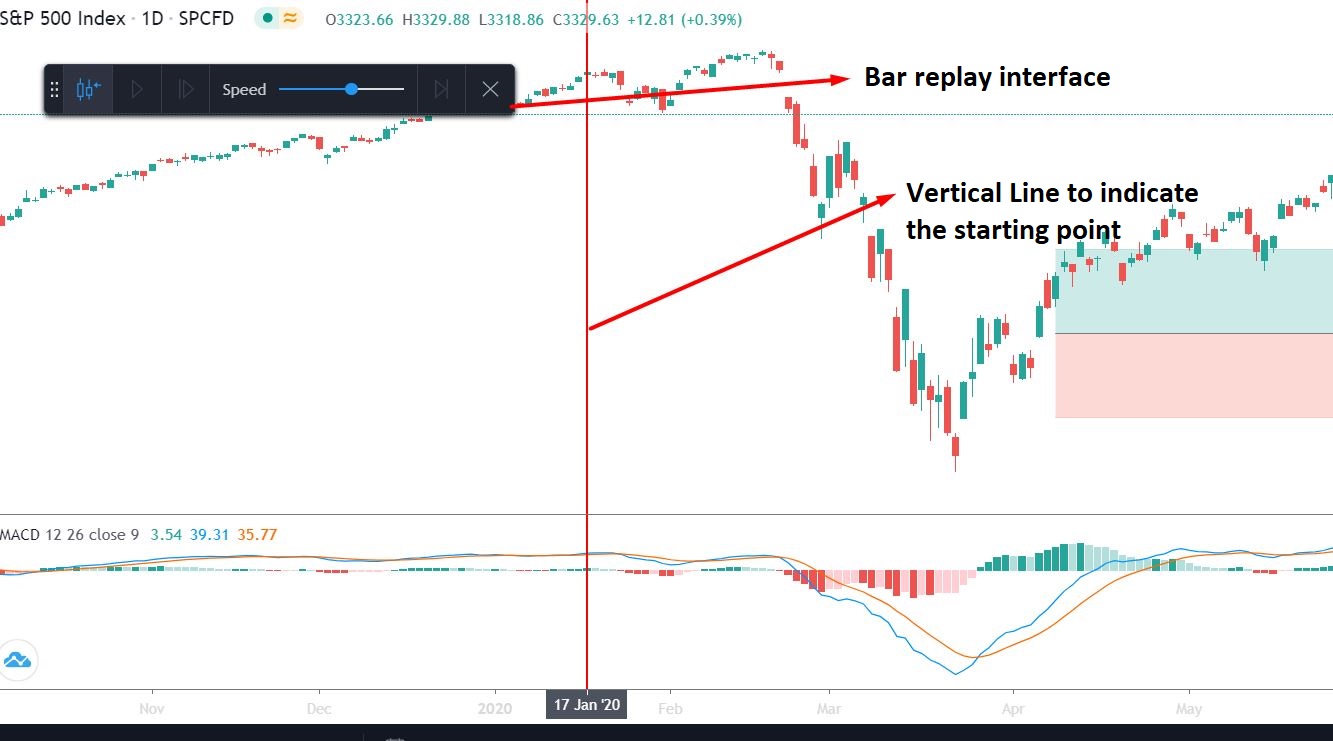

Later on, when you turn the bar replay option on, and it will appear on the chart. There will be a red line, which will be the point where you want to backtest the trading strategy.

Therefore, do not start the backtesting until you reach the date from where you want to backtest.

Like the stock backtesting strategies and want to try them out? Do it with an AtoZ Approved broker for free:

Start the Bar Replay

This option is straightforward. You have to put the start button with your mouse cursor.

After starting the bar reply, you will see the price as each was in a current market situation. Therefore, you can analyze and predict the market movement and play the bar reply to see what is happening next.

Pros of Tradingview Backtesting

- Accessible to Access from a web-based platform

- Manual Backtesting

- Free for all tradingview users

- Mostly accurate financial data.

- Lots of trading indicators to use as a strategy

- Lots of trading instruments like Forex, stocks, cryptocurrencies, and ETFs

Cons of Tradingview Backtesting

- Backtest will not happen automatically

- It does not include fundamental analysis.

- Some assets have limited price data

- You cannot use indicators that have a security function in playback

Conclusion

Tradingview is a fantastic stock backtesting tool that allows you to determine why the trading strategy is not working and the reason behind it. Therefore, you can identify the reason behind failure, and you can make the plan better and test again.

Make sure to backtest for more than two years to achieve a better result as we know that the global economy goes through some recession or boom phase. Therefore, in some years there might be a good movement in the stock, but later years it might not work as before. Thus, selecting more than two or even five years of testing allows you to cover all types of market conditions in your trading strategy.

We know that there are risks in the financial market that we are unable to avoid. So no strategy can give you a 100% profit. However, if your trading strategy is not giving above 50% benefit, you should change it. You should identify the reason behind the failure, and tradingview is a fantastic tool to do this. There are lots of other backtesting tools available on the Internet that allows automatic trading considering fundamental aspects. As we refer to in this article, if you want to do more, you can use one of these.

Should you use backtesting strategies on your own at all?

Before you start the time-consuming process of developing a strategy based on backtesting, you'll want to read this.

Our in-house trading expert Dr Yury Safronau, PhD in Economic Sciences, gives you daily his best stocks, forex and cryptocurrencies to buy and sell signals right now. And it's not just based on a simple singular backtested strategy.

His trading approach which is based on non-linear dynamic models has achieved more than 65 000 pips of profits since 2015. And right now there are some strong buy signals across several markets you definitely don't want to miss.

Want to see which ones?