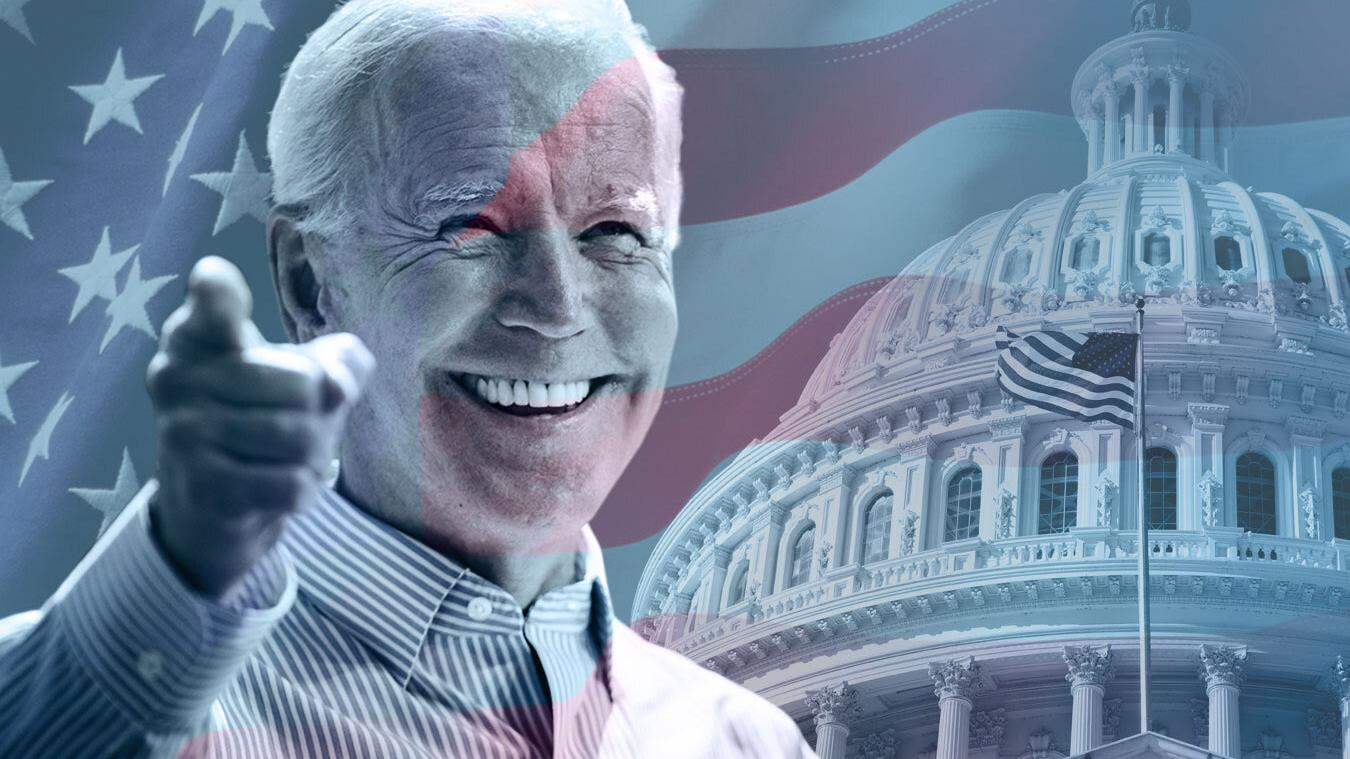

US President Joe Biden has signed into law a $1 trillion infrastructure bill containing, among other things, controversial provisions on taxing cryptocurrencies.

“For too long, we’ve talked about having the best economy in the world. [...] Today, we’re finally getting this done,” said the US president. “America is moving again, and your life is going to change for the better.”

The bill as it was passed will implement tighter rules on businesses handling cryptocurrencies and expand the reporting requirements for brokers.

Biden signs infrastructure bill without crypto amendments

The document contains an expanded definition of the concept of "broker". Depending on the interpretation, miners and node operators in blockchains, wallet developers, liquidity providers in DeFi protocols and other non-custodial players may be required to report to the Internal Revenue Service (IRS) on the activities of their users.

The requirements of the bill in this form are technically impracticable, for which the document has been repeatedly criticized by representatives of the crypto industry, including Elon Musk and Jack Dorsey.

Senators Ron Wyden, Cynthia Lummis, and Pat Toomey have proposed excluding crypto industry participants from the bipartisan plan. Their colleague Rob Portman put forward a counter amendment that exempts only miners and sellers of hardware or software from tax reporting, leaving the status of PoS validators unclear.

On August 9, Democrats, Republicans, and the Treasury Department reached a compromise, but the corresponding amendment did not receive unanimous support - 87-year-old Richard Shelby opposed it.

Simultaneously with the signing of the infrastructure plan by Biden, Senators Ron Wyden and Cynthia Lummis again proposed to limit some of the tax reporting rules for cryptocurrencies in it. They will come into effect on January 1, 2024.

Read also: Biden Freezes FinCEN's Proposed Cryptocurrency Regulations

Senators Lummis and Wyden are introducing a bill to narrow some of the cryptocurrency tax reporting rules in the infrastructure bill being signed into law today. https://t.co/uswxB3eeCB pic.twitter.com/xRQJGbv2Rs

— Jerry Brito (@jerrybrito) November 15, 2021

“In the bill, we made it clear that the new reporting requirements do not apply to those developing blockchain technology and wallets,” Weiden explained.

Bloomberg explained that it remains unclear when the document will be submitted for consideration and whether it is possible to include it in other initiatives before the end of the year.

Recall, CNBC, citing an official from the Ministry of Finance, reported that the agency does not intend to broadly interpret the definition of "broker" to industry participants.

Earlier, the community was concerned about another amendment to the infrastructure plan, which will oblige recipients of digital assets worth more than $10,000 to verify the sender's personal information.

Think we missed something? Let us know in the comment section below.