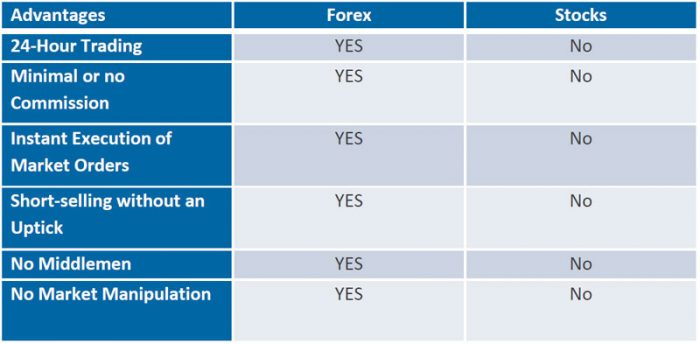

AtoZForex – Forex trading has many similarities to stock trading. However, I see a lot of differences in both of them. Below is a spell out of some of the major Differences Between Forex and Stock Trading that might not be conspicuous to everyone.

Top 5 Differences Between Forex and Stock Trading

I personally recommend that the forex market is one of the best markets for intraday trading. But still, I suggest that you should practically analyze the difference between the forex market and the stock market and after that make a decision.

Trading Hours

Both the Forex market and stock market function in a strict timing. The Forex market operates 24 hours in a day in 3 break sessions throughout the year. Although the Forex market does not overlap and you can choose between Asian, European and US trading hours.

Trade Forex safely with an AtoZ approved broker:

Moreover, the stock market usually operates for 7-8 hours in three trading sessions. The pre-market opening is also a part of stock trading where traders can place their orders before the actual market trading session.

The New York Stock Exchange (NYSE) opens at 09:30 and closes at 16:00 local time. Whereas, Frankfurt Stock Exchange- Deutsche Borse operates for the longest trading session from 09:00 to 20:00 local time.

Trading Marketplace

Unlike the stock market, the Forex market is a completely independent marketplace for traders. It is also called an over counter exchange (OTC). It can be traded according to the location, demand-based, and government rules and regulations. Like in some countries it's partially illegal to trade different currency pairs.

For India, trading on other pairs rather than defined by RBI is illegal under FEMA Act.

However, the stock market is centralized within the country. This is mainly located in one place like New York Stock Exchange (NYSE), London Stock Exchange ( LSE), and Bombay Stock Exchange (BSE). So, the Forex market in terms of liquidity is bigger than the stock market.

#3 Financial Friction

The stock market always requires a broker to invest our trade your money into the market. This results in more financial friction or high brokerage charges. Every time a stock is sold there is a broker or an entity for buying or selling.

But in the case of the Forex market spot buying is effective because Forex is not centralized. In Forex market spread is transparent. Most brokers don't require additional transaction fees or even charge brokerage charges such as XTB online trade, and Orbex trade even provides free trading platforms, demo accounts, and live accounts.

Difference in Leverage

The minimum amount which we require to trade any particular asset unit is called leverage. If we talk about the stock market, the leverage offered is normally around 5:1. In the Forex market the leverage is ten times more than the stock market i.e 50:1 at least or more than that. Many forex brokers offer normal leverage of 100:1 which may range up to 500:1. Shocked!! the trader will get a leverage of up to $500,000 by deposing $1000 in the trading account.

Trading Speed and Complexity

The Forex market has superior liquidity as compared to the stock market. Forex trading is done over the counter which means the trade is executed instantly without any delay. In the case of stock market trading, you need to wait for the order to get executed because of the broker in between the trade.

Trade Forex safely with an AtoZ approved broker:

Some people think that Forex trading is more complex than the stock market and you need to know a lot of formulations and strategies to trade Forex. Here are the Top 5 Free MT4 indicators which Forex traders must use while trading. Many Forex websites provide Free Daily Forex signals and Free Forex education to trade in Forex market.

Should you trade Forex on your own at all?

Before you start trading the Forex market, you'll want to read this.

Our in-house trading expert Dr Yury Safronau, PhD in Economic Sciences, gives you daily his best forex, metals, and cryptocurrencies to buy and sell signals right now.

His trading strategies which are based on non-linear dynamic models have achieved more than 65 000 pips of profits since 2015. And right now there are some very strong buy and sell signals across several markets you don't want to miss.

Want to see which ones?

Think we missed something? Let us know in the comments section below.