28 October, AtoZForex.com, London – Bank of America Merrill Lynch discusses how real interest rates and inflation break-evens explains both the short-term dynamics and the real rates framework in the G4 FX providing its FX projections & targets for EURUSD, USDJPY, and GBPUSD.

EURUSD

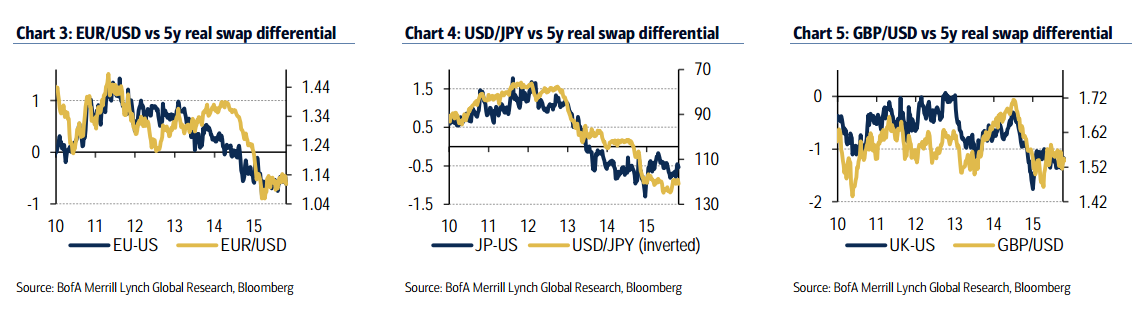

The EUR – USD real rate differential had a close correlation with EURUSD over 2015 (see Chart 2). A 1000 pip appreciation in EUR since March until last week coincided with a 35bp rise in EUR 5y real rates relative to USD. However, the ECB’s dovish rhetoric managed to reverse the trend by around 15bp, BofA argues, yet leaving the real rate differential above the March levels.

Now the question is whether the ECB could recreate downward pressure on real rates via credible monetary easing measures in December. “We believe it can and Chart 2 suggests a further 20bp fall in 5y real rates would be sufficient to take EURUSD to our year-end target of 1.05," BofA projects.

USDJPY

In BoJ case, while QQE2 effectively weakened the JPY, it is less certain that it managed to lower the real rates (see Chart 4). BofA thinks the portfolio outflows was the main driver of the exchange rate. Yet, it begs the question whether additional easing by the central bank would be enough to weaken the yen again. Notwithstanding, it depends whether BoJ can amend inflation outlook to better over the coming months.

“While it is true that BoJ action in isolation is unlikely to be sufficient, we believe that more reflationary measures from Abe’s government could help. Along with evidence of increasing portfolio outflows, we think this should take USD/JPY to 125 by year-end," BofA adds.

GBPUSD

Lastly, GBP has historically been one of the most sensitive currencies to policy divergence from G10. Though in recent months the real rate differential has provided little guidance.

“With positioning lighter and the domestic fundamental backdrop still strong, we expect GBP to perform well over the medium-term, although more against the crosses than the USD," BofA advises, targeting GBPUSD at 1.48 by the year end.

Think we missed something? Let us know in the comments section below.