03 February, AtoZForex.com, London – The Reserve Bank of Australia (RBA) left the cash rate unlamented at 2 percent, in line with the RBA’s previous outlook of gradual improvement in the domestic economy. The accompanying statement outlined the risk of potentially softer global demand but still was relatively upbeat about domestic job market conditions.

Post RBA outlook

FX commentary was relatively unchanged, and continued to reflect consistency with the commodity prices. All in all, additional information from the RBA’s Monetary Policy Statement (MPS) will appear on Friday.

“Recent dovish surprises from the ECB, BoJ and RBNZ arguably caution against turning too complacent on the RBA, and there is scope for a more dovish signal in the statement on Friday," BNP Paribas added.

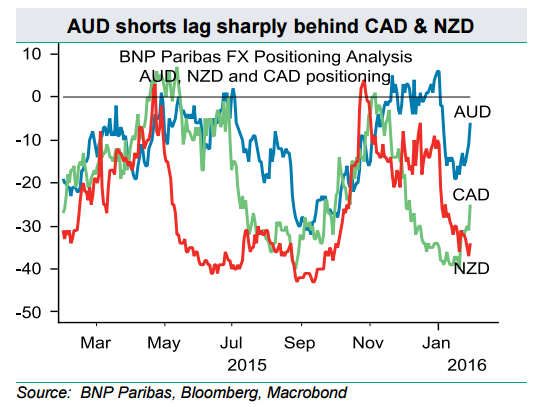

Against the current risk-of market environment, diminishing expectations of further Fed tightening should increase pressure on the RBA, and other major central banks, to ease monetary policy further. In particular if the AUD remains at elevated levels relative to other G10 commodity currencies such as CAD or NZD.

BNP Paribas FX Positioning Analysis indicates that a considerable potential for AUD shorts exists to catch up to others devalued commodity currencies.

Consider reading: BoAML: EURUSD below parity at year-end

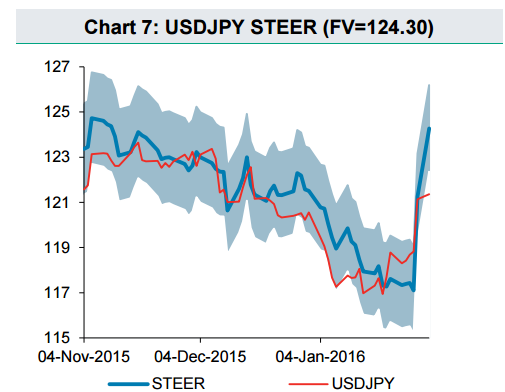

USDJPY STEER model findings

BNP Paribas quant model “STEER” suggests that USDJPY has room to rise further, following the BoJ surprise rate cut on Friday which caused a massive 300 pip rally.

However, despite the “STEER” signal, safe haven seeking currency investors should keep JPY bid as long as cheap commodity prices and risks from China persist.

Source: BNP Paribas

Source: BNP Paribas

Nevertheless, STEER indicates a long USDJPY signal targeting 124.27 area.

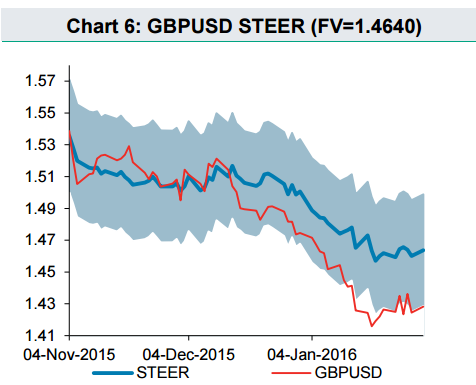

GBPUSD STEER model findings

Moving on to GBPUSD, the Cable continues to appear cheap against its STEER value, as postponed BoE interest rate hike and fears of Grexit weight on the GBP.

Source: BNP Paribas

Source: BNP Paribas

STEER runs a long GBPUSD targeting 1.4637.

Think we missed something? Let us know in the comments section down below!