AtoZ Markets - ATR is a very well-known trading indicator, which is used by many professional traders. RSI indicator, ADX indicator, Parabolic SAR are also the most popular indicators developed by J. Welles Wilder Jr. Traders also can use ATR indicator to measure other markets volatility such as stocks, forex, mutual funds, and futures contracts. This article will help you to understand how ATR indicator works.

What Is the ATR (Average True Range) Indicator?

J. Welles Wilder Jr. has developed ATR indicator as like his other indicators, with keep in mind commodities and daily values. Stocks are quite less volatile than commodities. Stocks are often mattered to gap market and move less. It happens when a commodity rises and falls its highest allowed movement for the session. The ATR had built to capture the missing volatility of the market. It should be noted that ATR only provides market volatility, not price momentum.

In the book called "New Concepts in Technical Trading Systems," which published in 1978, J. Welles Wilder Jr. features ATR indicator. He also introduced in this book about the Parabolic SAR, RSI and the ADX (Directional Movement Concept). Wilder's indicators have become most popular among the traders, though he developed them before the computer age.

The Formula of True Range

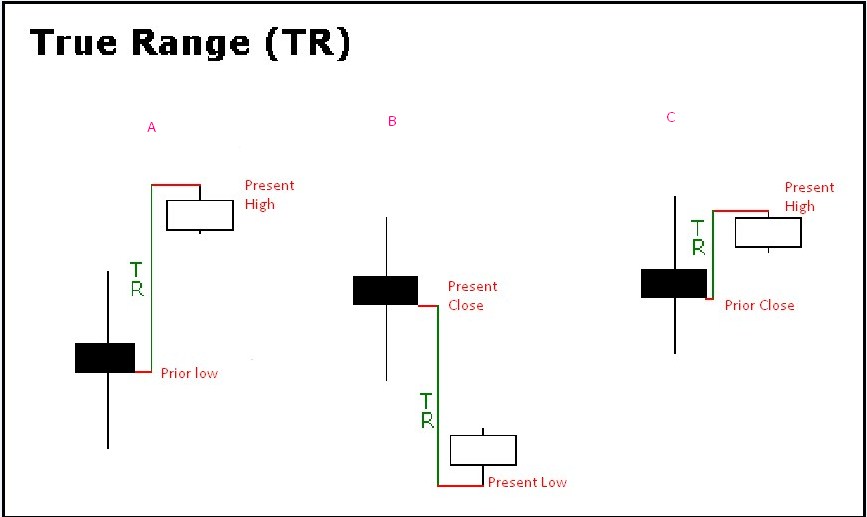

True Range (TR) is the main concept of Wilder, which formula illustrates the following:

- Present high less than the present low

- Prior close (ultimate price) more than the present high

- Present low less than the prior close (ultimate price)

Want to try the ATR Indicator? Start with a free account from an AtoZ approved broker:

To confirm positive numbers, we used the ultimate price. However, J. Welles Wilder Jr. always attracted to standardized the difference between the two points, not the direction.

True Range happens when the present time's high is above the previous time's high and the low is below the previous time's low, according to the calculation of formula 1. Besides, to measure the gap, formula 2 and 3 are used.

A gap happens when the prior close is higher than the present high, or the prior close is lower than the present low.

Illustration A: The high-low range occurred after a gap rise. The ultimate value of the difference within the present high and the prior close equalled True Range.

Illustration B: The high-low range occurred after a gap fall. The ultimate value of the difference within the present low and the prior close equalled True Range.

Illustration C: The high-low range is very smaller than the prior range (A and B). The ultimate value of the difference within the present high and the prior close equalled True Range.

ATR Calculation

ATR setting can be changed by user preference. The shorter in value, the more trading signals it will generate. However, a longer period can generate high probability trading signal rather than a shorter period. Therefore, a trader can calculate five-day ATR also.

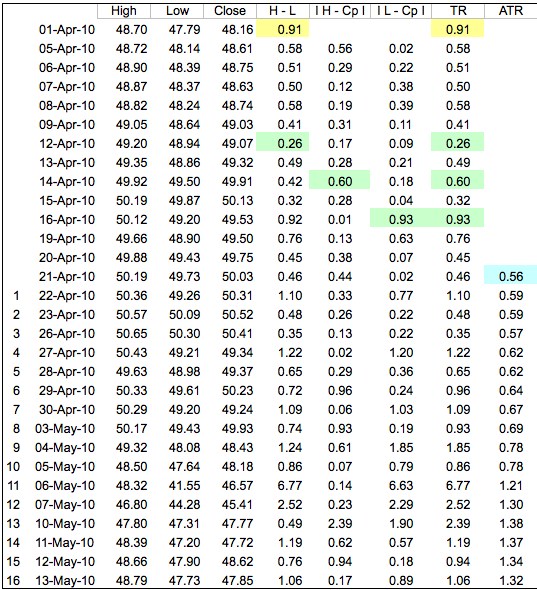

The trader trace the maximal assured value of the current high subtract the current low, the assured value of the current low subtract the former close and assured value of the current high subtract former close, pretending that the historical price data arranged inverse chronological series.

For the five most recent trading days, these calculations of the true range are done. The result has averaged to calculate the first value of the five-day Average True Range (ATR).

For example, (.91) is the first True Range value, which equals the High minus the Low (yellow marked). By discovering the mean of the first 14 True Range values (blue marked), ATR first 14-day value had calculated. Next ATR value will appear smoothly by using the formula above.

Try the ATR Indicator on a free trading account with an AtoZ Approved broker:

The below chart will help you to understand it batter the spreadsheet values, just look at the ATR line and how it climbed higher as the price dropped with long candlesticks.

The first True Range value is so simple to calculate, just minus the current low from the current high. The first 14 True Range values will be the first mean ATR. The original ATR formula lasts until day 15.

How to Use ATR Indicator

J. Welles Wilder Jr. has mentioned an ATR trading method that was the main part of his trend-riding volatility system. For example, think you have entered a trade following the trend and the market creating new high every day. The method of this trading strategy is very simple to follow, which also order where to stop and take the opposite trade. Follow the steps:

- Multiply the ATR by an actual. J. Welles has consulted 3.0 as actual and ARC as a resulting value

- Look for the SIC (significant-close). It's the high close in the past 'N' days

- Turn your trade one ARC from the SIC

To deliver an adequately fast repercussion to volatility, 'N' was set at 7 for these rules. It was developed for usage with daily values. ATR may use as a lead to the propensity in the market for imitating price moves, in a larger sense. As an example, if a strong propensity stays for therewithal buying that the range will maintain to extend, only then a market turns higher.

ATR Limitations

Average True Range indicator has two limitations, like:

- ATR open to explanation. For a counter-trend riding, ATR unable to tell you that the trend is about to reverse or not. It only shows the strength or weakness of the trend.

- ATR only able to tell you the market volatility, not the direction. ATR gives mixed signals, especially while markets are undergoing pivots.

Summary

For patrolling on volatility, ATR is a reliable chart analysis tool. It is the all-time necessary alterant for investing and charting. Trying to detect a trading range or measure the all-up capacity of a move, ATR is a favourable option. It is known as an indicator that is used excellently as a multiplier to lead more price direction indicators. ATR may affix an elevation of boldness to benefit in a move, after starting the movement.

Should you use the ATR Indicator on your own at all?

Before you start trading with this ATR Indicator, you'll want to read this.

Our in-house trading expert Dr Yury Safronau, PhD in Economic Sciences, gives you daily his best stocks, forex and cryptocurrencies to buy and sell signals right now. And it's not just based on a simple singular backtested strategy.

His trading approach which is based on non-linear dynamic models has achieved more than 65 000 pips of profits since 2015. And right now there are some strong buy signals across several markets you definitely don't want to miss.

Want to see which ones?