AtoZ Markets – Most of the traders speak about forex market exhaustion without having any deep knowledge about it. The common mistake traders usually make by considering all prices are the same, which is not correct. The currency pairs in the forex market are an auction process. It moves up to find sellers and then moves down to find buyers. Moreover, at each level, the volume might differ depending on what traders are thinking about the value of the particular currency pair.

Another common mistake most of the traders do is thinking that exhaustion as a reversal signal only. They ignore the logic and reason behind the exhaustion candle, which we will see in the following section.

Market exhaustion may happen in a bullish market when sellers reject lower prices. On the other hand, it may happen in a downward market as buyers reject higher prices. The reason behind the bullish trend is not just because buyers are controlling the market. It may happen due to the reason that aggressive sellers are not willing to sell at lower prices.

Let’s start with the Dow Theory before moving deep insight the forex market exhaustion.

The Dow Theory

The Dow theory indicates that every trend undertakes three stages:

- Accumulation: It is the start of a new trend. This phase is fueled by big players and innovators. This phase is a transition phase between a downtrend and an uptrend or uptrend and a downtrend. In this phase, new traders become worried about further sell-offs while professional traders are already in long.

- Participation: This phase defines the step when more usual investors place themselves long as this level becomes more observable that the current trend might have changed. The participation phase is powered by fundamental news after the recovery of a downtrend.

- Excess: During the excess market phase, the early informed investors wind down their long positions that increase volatility. Within this phase, the uninformed market participants enter the trend way too late as they don’t like to miss out.

As we can shortly, the Dow Theory is very important to understand the market structure that we can apply to smaller timeframes, intra-day or long term time frames. Within the structure, the excess phase has the most uninformed investors. Therefore, the market crash and exhaustion happens mostly in this phase.

Want to trade forex with a regulated broker? Open a live account with AtoZ Markets approved Forex brokers:

Why Do Exhaustions Happen in the Forex Market?

Let’s start with a story to understand the concept of Exhaustion.

Let’s assume that you have 20 friends. Say 10 of your friends want to go for a casual run. Therefore, after running a few kilometers, some of your friends will say “I am exhausted; I need to take a rest”. Therefore, they will quit running.

After running further, another bunch of your friends will say “I am exhausted. I can’t run further” and they also will stop running.

After running further, there will be a stage where all of your friends will leave running. Now a stage will come where only you will continue the running. After running further, you will also say “I am also exhausted”, and you stop running. Therefore, there is no one left in the running. This means all of your friends, including you are exhausted in the running.

The same principle applies to an exhaustion bar in the forex market where most of the buyers or sellers stop doing anything. This may happen due to the fear of losing money. Some unexpected economic events like coronavirus outbreak, financial recession, geo-political issues, wars might be reasons behind it.

If we can identify the exhaustion bar with all the available tools, we can win a big trade for sure! Most of the exhaustion bar forms at the top or bottom of a currency pair in the forex market. As the forex market has a variety of currency pairs, we can trade in exhaustion bars to make lifetime gains.

Want to trade forex with a regulated broker? Open a live account with AtoZ Markets approved Forex brokers:

How to Spot Exhaustion Candles?

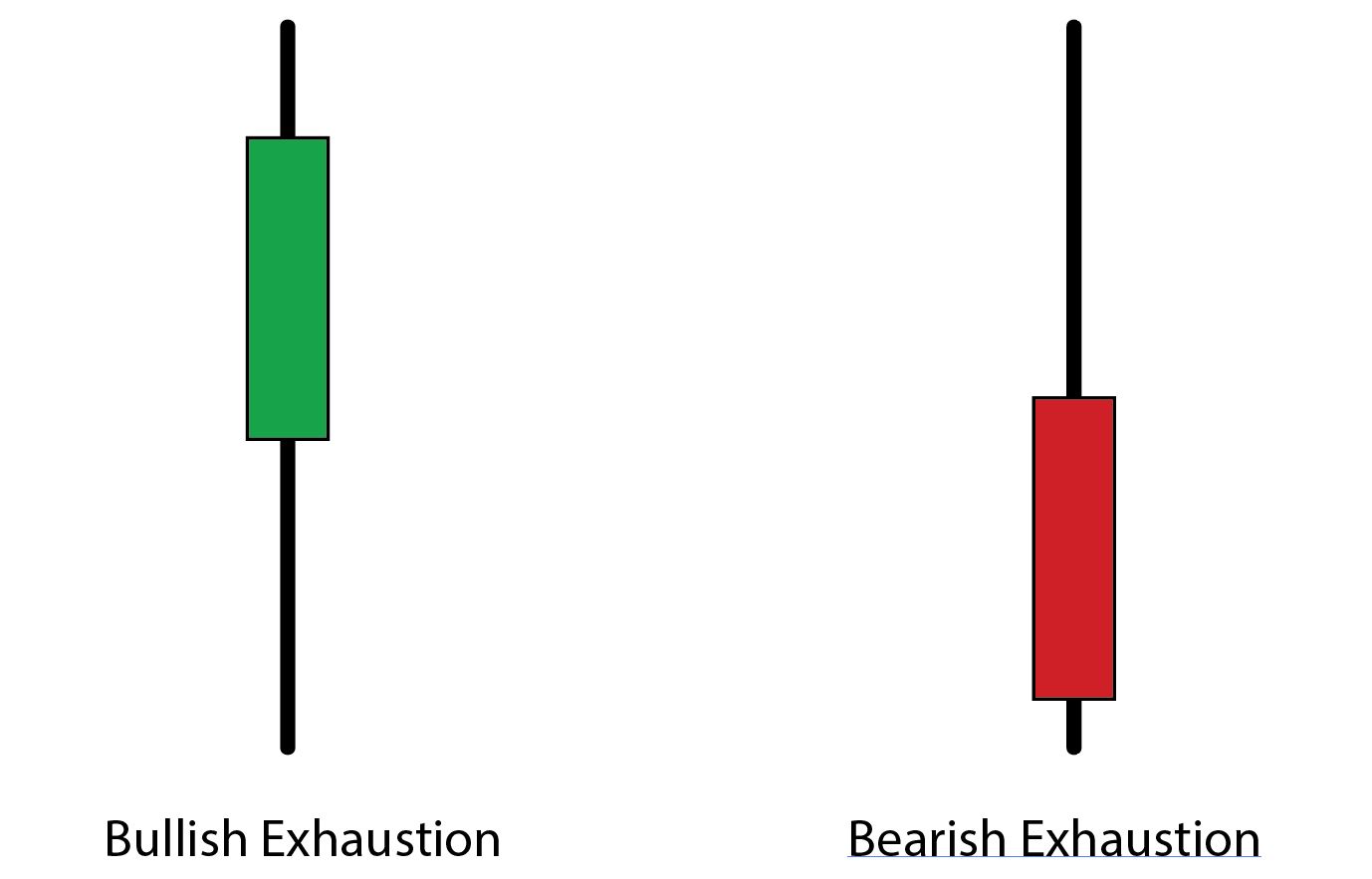

The exhaustion candle is a significant indicator of a trend reversal. Some traders call it to hammer as the market may try to hammer out the bottom.

The exhaustion candle appears during a trend only. The body of the exhaustion candle has a long wick that is at least 2-3 times higher than the length of the body. It is very easy to see with candlestick charts and is bigger and unusual compared to all other recent candlesticks.

Within the exhaustion candle, the color of the body does not matter. So the conditions for exhaustion candle are as follow:

- It appears after a long move or in an excess market phase

- The wick of the candle is 2-3 times higher than the body

- It mostly appears at the top or bottom of a currency pair.

How to Trade Exhaustion Candles?

Traders can use exhaustion candles as a principal indicator to enter a trade based on the candle only. The reason behind this is that a significant amount of information is embedded in the exhaustion candle. This candlestick provides clues about what is happening in the overall market and what the current sentiment is indicating. This might be an indication that the current trend is stalling or reversing. However, it is just an indication. Therefore, we need some other confirmation than that.

- Identify the Market Direction: To identify the market direction, you can identify the logical reason behind the movement. In a longer timeframe, it may happen due to the fear and greed of the price. Therefore, in a higher timeframe, you should identify the top and bottom of the price and the current trend.

- Entry: The entry of the trade depends on the trading style of the trader. An aggressive trader will take the entry immediately after opening the next bar following the exhaustion candle. The conservative trader will take the entry after breaking either high or low of the exhaustion bar. Conservative traders will enter the position only when the price breaks the opening price of the exhaustion candle.

- Stop-loss: The logical stop- loss will be on the higher or the lower of the exhaustion bar. However, it depends upon the risk appetite sentiment of a trader.

- Take- profit idea: As the exhaustion, the bar indicates a new trend. There is a possibility that traders can get the maximum benefit from trade. Therefore, traders can make some partial close and extend the take profit towards the next key support and resistance levels.

Coronavirus Outbreak May Create Market Exhaustion

If you have read the above section of the article, you probably know the logic behind the formation of market exhaustion in the forex market.

Want to trade forex with a regulated broker? Open a live account with AtoZ Markets approved Forex brokers:

If you look at how the coronavirus outbreak expanded the world and creates fear among the investors’ minds. Therefore, most of the investors started to follow a specific direction due to fear. This event has enough reason to create market exhaustion in the forex market.

There is a possibility that you will see a 1000 pips movement in a daily chart of a currency pair from the top or bottom and then recover the whole movement on the next day or the next week. This type of movement may start a new trend towards the opposite direction of the current trend. However, the thing traders should follow is that they should make sure that the reason behind the movement is not active right now.

Moreover, for retail traders, it is quite impossible and unwise to take a stop loss of 500 or 1000 pips. Therefore, traders may do multi-timeframe analysis from weekly to daily intraday charts.

Read more: How to Trade Intraday Using Support and Resistance Levels

Summary

The forex market exhaustion creates a new market direction for traders. Therefore, traders who know how to trade exhaustion can grab a lot of pips from it. However, we know that the forex market is the world's biggest financial market. Therefore, it is quite impossible for retail traders to know about what the big players are planning to move the price. So your good A+ setup might go wrong even if it follows all conditions.

Therefore, trade management and money management is the key to remain successful in the industry. Make sure to invest the money that you are ready to lose. Never take too much risk of your balance to a single entry and make sure to move your stop loss at break-even as soon as price breaks some important key or event level.

Should you trade Forex on your own at all?

Before you start trading Forex, you'll want to read this.

Our in-house trading expert Dr Yury Safronau, PhD in Economic Sciences, gives you daily his best forex, metals, and cryptocurrencies to buy and sell signals right now.

His trading strategies which are based on non-linear dynamic models have achieved more than 65 000 pips of profits since 2015. And right now there are some very strong buy and sell signals across several markets you don't want to miss.

Want to see which ones?