02 June, STO, Limassol – Another month, another Non-Farm Payrolls reading. Since the NFP measure has one of the biggest effects on the market from monthly scheduled data, it is worth to be prepared. As an old proverb goes, “Fail to plan, and you plan to fail.” Therefore in this article we will look into how to prepare for NFP announcement.

How to prepare for NFP

The NFP announcement, scheduled the first Friday of every month 13:30 BST, does not just cover one data, but instead multiple employment related readings including:

- Actual NFP data

- Several unemployment figures

- Average hourly earnings

- Average weekly working hours

- Average participation ratio

These are the major numerical announcements that investors would need to look into and make sense out of to understand the real US labour situation.

NFP sneak-peak

However, before the above data set is published we will have a sneak-peak into NFP from today’s ADP Non-Farm Employment Change, scheduled 13:15 BST with a consensus of 177k up from 156k, and Unemployment Claims, scheduled 13:30 BST with an expected, nearly unchanged reading from last month of 270k.

Although both labor estimates are not directly correlated with the actual Payroll reading, they do show the underlying trend. Hence, the first NFP estimate, at least higher or lower than the prior month, could be determined today at noon.

Key NFP levels

The next step in how to prepare for NFP is to determine the key NFP levels. Anything above 200k could be viewed as USD positive, assuming the rest announcements show no change or are better than expected.

Now, to leave the Fed’s benchmark 6 month average labor growth figure above 200k tomorrow’s reading should be at least 140k. Therefore, anything near could trigger a USD sell-off.

Meanwhile, area in between the 140k and 200k could be viewed as somewhat neutral with increased importance on the rest of the data and the actual surprise/disappointment range from consensus estimate.

Technical analysis

Technical analysis of the traded currency pair should be done at least a day before and during the day of announcement.

Looking at EURUSD, the currency pair has been freefalling since the turn of May, hence the old adage “Sell in May, and go away.” At the moment, Euro has found itself a support at an alignment of 200 day moving average and a psychological level at 1.11.

EURUSD, support and resistance levels (click to zoom)

EURUSD, support and resistance levels (click to zoom)

With a strong support in place, the pair is aiming towards an immediate resistance levels at 1.122, 1.128, and 1.300. Meanwhile, key support levels are at 1.113, 1.11, and 1.100.

Analysing the data

Lastly, following the immediate market impact of labor publications on Friday 13:30 BST, aftermath could be determined by analysing the data.

For instance, if Non-Farm Payrolls reading would beat the current expectations of 163k but average weekly working hours and wages would decreases, this would mean that the new job positions were created at the cost of cutting the existing employees working hours and wages. Hence, the USD would likely depreciate if it initially rallied at the announcement.

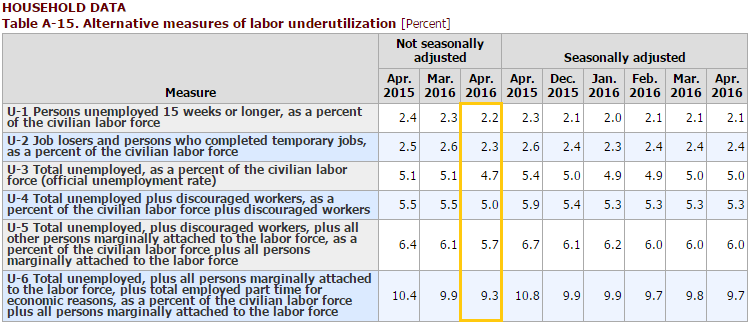

Source: Bureau of Labor Statistics, A-15 Table, How to prepare for NFP

Source: Bureau of Labor Statistics, A-15 Table, How to prepare for NFP

In addition, you might need to go an extra mile and analyse alternative measures of labor underutilization. Recall the latest NFP reading which was released at 160k despite a consensus of 203k. Although the data was dreadful both EURUSD and GBPUSD resumed the downtrend immediately.

A-15 labor underutilization data could explain why this was the case. All U- “Not seasonally adjusted” reading were significantly lower, overshadowing the negative effect of the subdued labor growth reading.

At this point I hope you feel more confident about understanding and preparing for tomorrow’s NFP data.

About the author:

The research was provided by STO research team. The company is an AtoZ Forex Approved, regulated Forex broker. Visit STO profile on AtoZForex.com broker directory for more information.