This weekly EURUSD technical analysis for September 5-9 includes a recap of last week’s Europe and US fundamental developments. More importantly, it contains the special outlook for the upcoming week. What should you pay attention to for EURUSD?

5 September, AtoZForex – The following are my Forex technical analysis for this week of August for EURUSD currency pair.

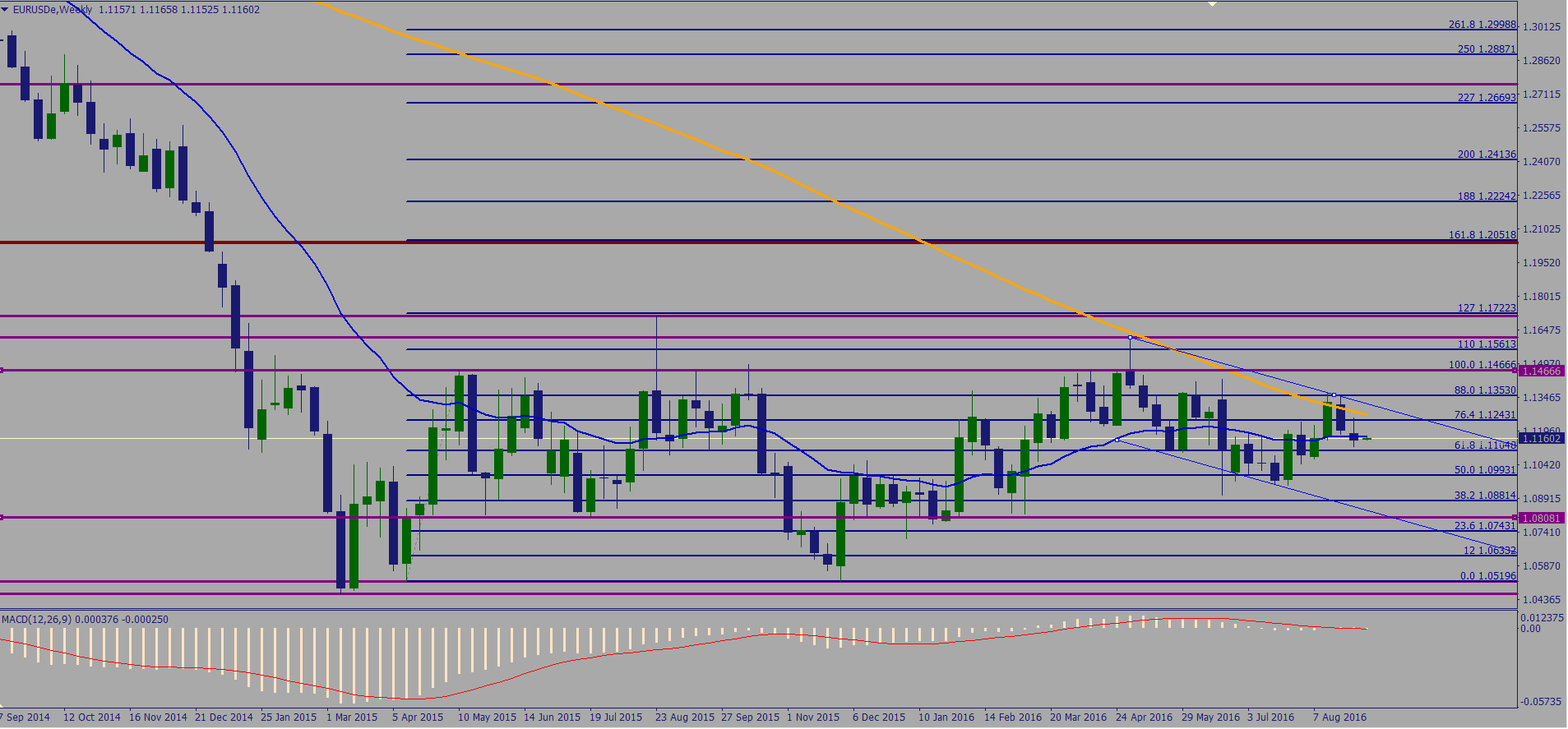

Weekly EURUSD technical analysis

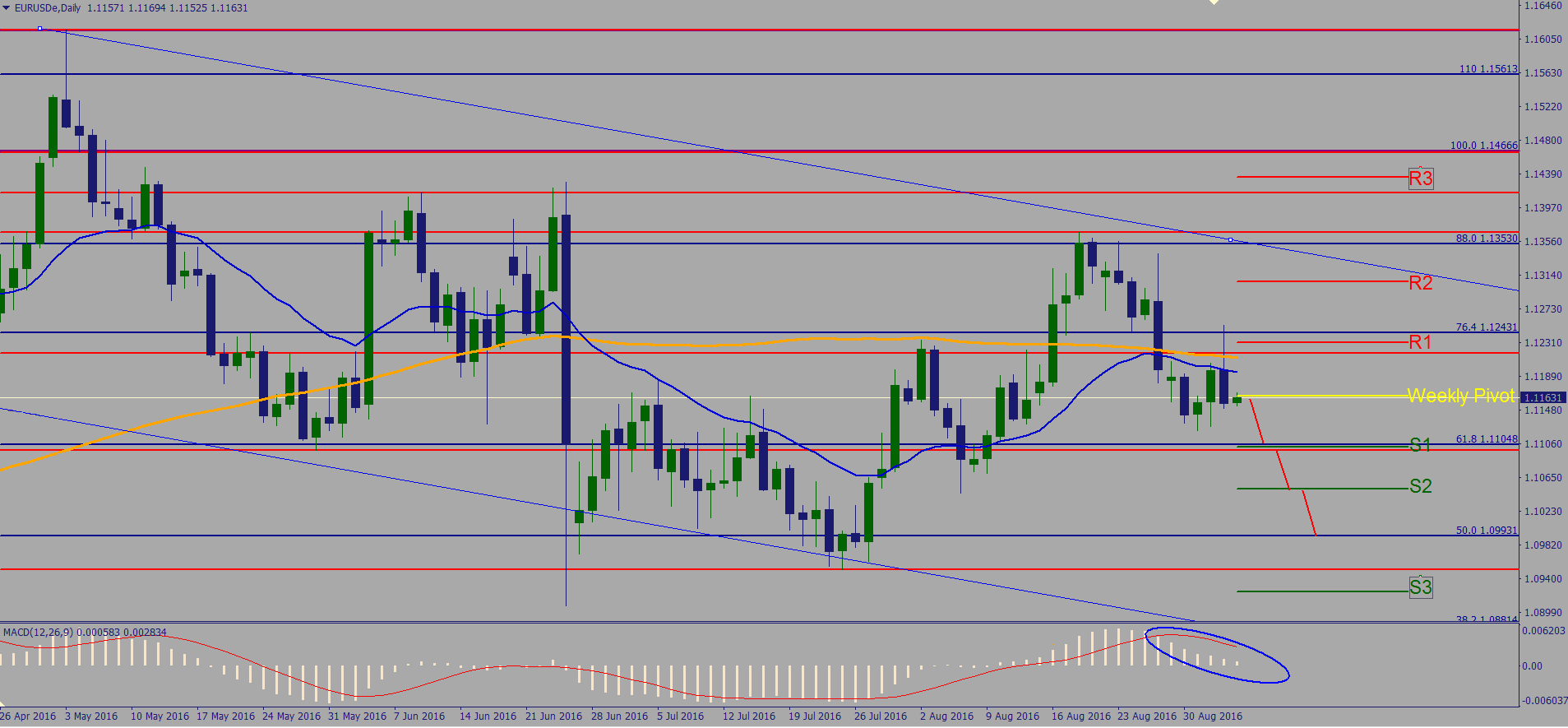

Major Resistances at 1.12308 (R1), 1.13060 (R2) and 1.14351 (R3).

Weekly Pivot at 1.11769

Major Supports at 1.11017 (S1), 1.10478 (S2) and 1.09187 (S3).

Fundamental developments last week

With little to none key economic data from Europe, the EURUSD pair was driven largely by US major events such as ADP, ISM Manufacturing PMI, Average Hourly Earnings, Unemployment Rate and market mover NFP. The pair started a short rally when ADP's outcome registered an insignificant increase followed by disappointing 49.4 points from the expected 52.0 for ISM Manufacturing PMI expected. It was the biggest decline of 3.2 points since January 2014. A result equal or higher than 50.0 indicates industry expansion, below indicates contraction.

Before the end of the week, the initial reaction to weaker than expected data for Average Hourly Earnings, Unemployment Rate and NFP the pair continued to rally. However, the euro’s gain eventually turnaround as the U.S. dollar rebounded. The NFP result of 151K was well below expectations of 180K, the chance of rate hike this month decreased significantly. However, the data may be enough to support a rate hike by December which could possibly be the reason for the immediate recovery of the pair.

EURUSD fundamental expectations this week

The major event this week for EURUSD pair is the widely anticipated European Central Bank’s monetary policy announcement on Thursday. The continued lack of growth and failure to produce inflation has led many economists to the expectation that the ECB might go for even more stimulus. Inflation remains well below target with year-over-year core CPI growth falling to 0.8% from 0.9% in August. This single event could be the only market moving event for the week, despite the fact no change in monetary policy is expected.

EURUSD technical analysis

According to Weekly EURUSD technical analysis, the pair is downtrend where it has formed lower low followed by lower high. From price action perspective EURUSD technical analysis also favours bearish movement. In addition, the moving average 20 and 100 are still plotted on top the candle which suggests a strong selling opportunity.

Weekly EURUSD Technical Analysis (click here to zoom in)

Weekly EURUSD Technical Analysis (click here to zoom in)

Also see: Weekly AUDUSD technical analysis for September 5-9

Daily MACD technical analysis, shows that in spite of printing above (0) level the slope of MACD line is going down and it is about to print below (0). From a moving average perspective, the bias is still on the downside as the candle is printed below 20 and 100 moving average. From today's EURUSD technical analysis we can expect a selling opportunity at the 61.8 Fibonacci Retracement level (1.11048) as the initial target profit level followed by 50.0% Fibonacci retracement level (1.09931) as the secondary target.

Daily EURUSD Technical Analysis (click here to zoom in)

Daily EURUSD Technical Analysis (click here to zoom in)

Think we missed something? Let us know in the comments section below.