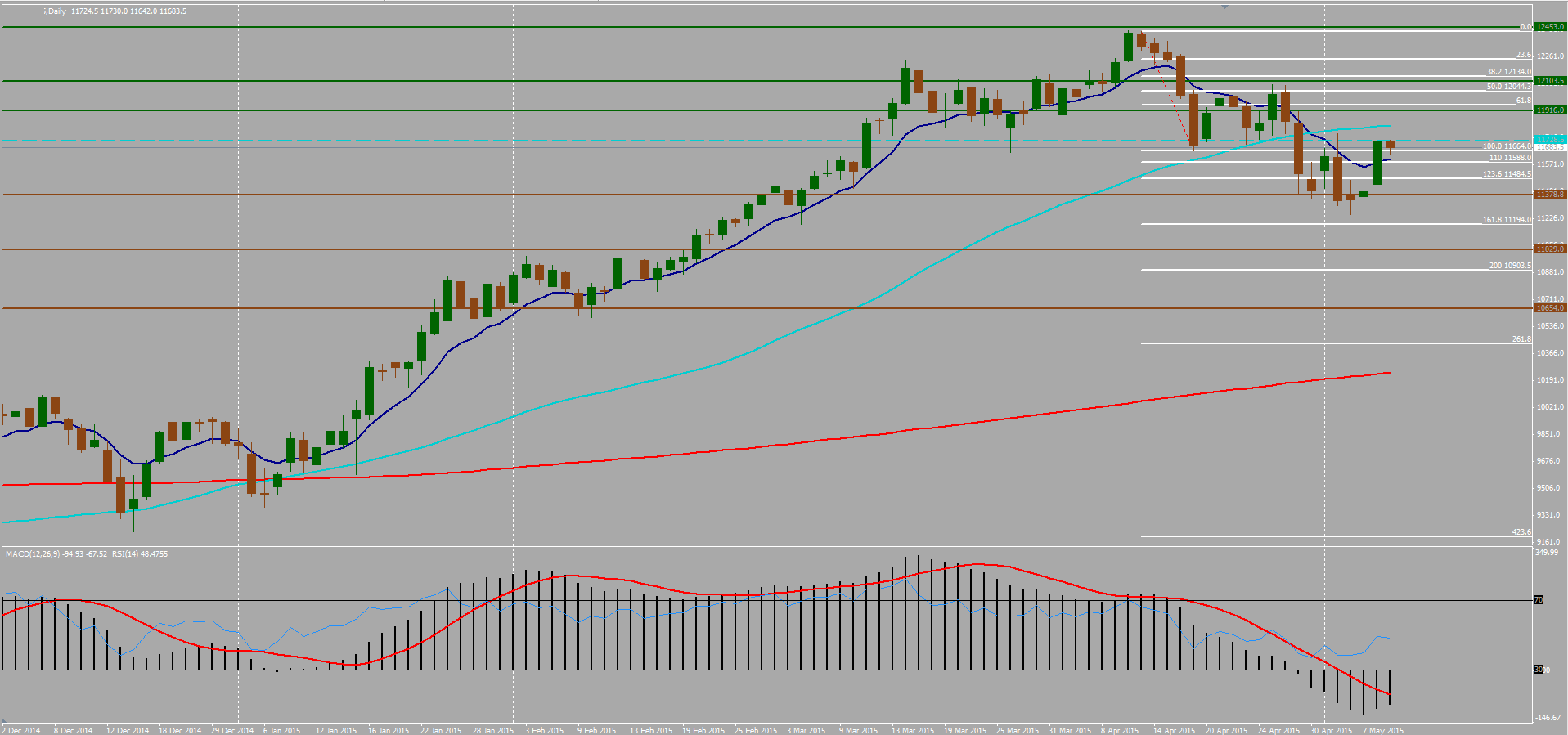

It was a crazy week last week, Dax index moved between 11178 and 11770 level, bouncing off the 161.8% Fibonacci retracement level.

With the positive NFP figures the Dax index pulled up its wings flying as high as 11740 before being hit by the Grexit issues earlier today. For this week Greece is again on the headlines, especially for the Eurogroup FinMins’ meeting today. It appears that every deadline brings a new deadline and neither the Greek officials nor the investors know which one to focus on. Nevertheless we are expecting to see some kind of supportive statement from Eurogroup today as we move closer to June deadline.

| Level | Support | Resistance |

| 1 | Fibo 100%: 11664 | Monthly Pivot line: 11728 |

| 2 | 5 day SMA: 11600 | 50 day SMA: 11826 |

| 3 | Fibo 123.6%: 11485 | Fibo 61.8% & Pivot R1: 11950 |

| 4 | Pivot S1: 11379 | Pivot R2: 12104 |

| 5 | Fibo 161.8%: 11194 | Pivot R3: 12453 |

Dax Technical Analysis:

Looking at the daily time frame, the index appears to be more bullish than bearish at the moment, despite Greek pressure. The index must break above 11728 which is monthly pivot point and 200 hour SMA in order to open the ground for the bulls to take control.

Moving on to H1 time frame we can see that the current level has got more resistance as we have 200 hour SMA, daily trend line and monthly pivot point is weighing on 11700 zone. Nonetheless, there can be some bearish move before we see some strong bull action.

I am expecting the pair to move towards 11500 zone towards our 3rd support point before seeing a jump towards 11826 zone.

The most important market mover for the Dax index is expected to be Wednesday's German q/q GDP figures. Most of the analysts are expecting some negativity, I think we may expect to see some neutral numbers.