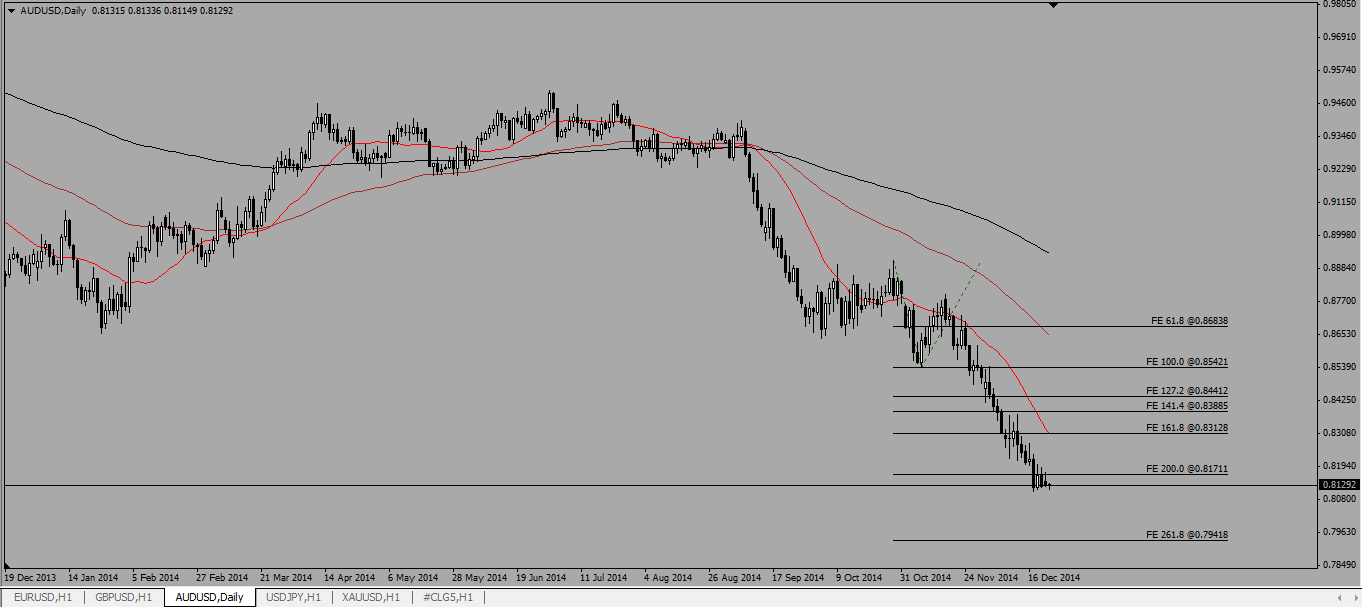

Candles have closed below Fibonacci extension 200.0% at 0.8171. A short retracement was observed where candles failed to close above 0.8171, turning 0.8171 into a resistance.

Candles have closed below Fibonacci extension 200.0% at 0.8171. A short retracement was observed where candles failed to close above 0.8171, turning 0.8171 into a resistance.

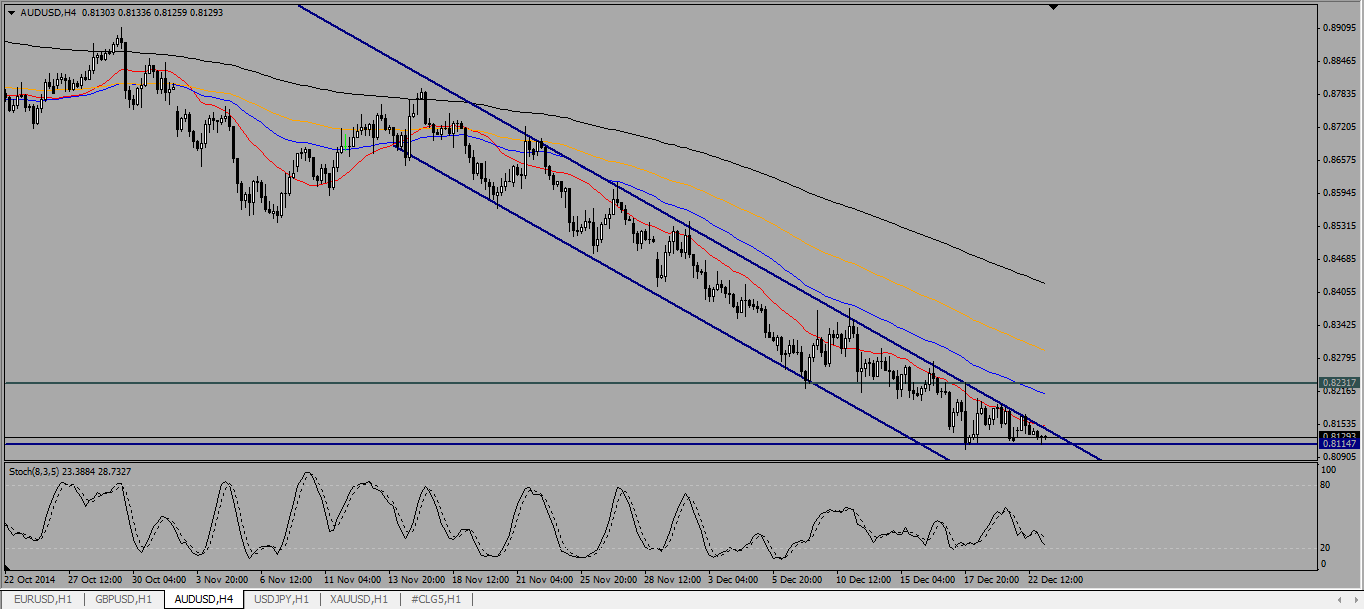

Focusing on H4 chart, 0.8114 continues to be a support for the pair. Candles lie near the top of the trend channel and if candles are resisted and falls below 0.81147, a shorting entry can be made.

Focusing on H4 chart, 0.8114 continues to be a support for the pair. Candles lie near the top of the trend channel and if candles are resisted and falls below 0.81147, a shorting entry can be made.

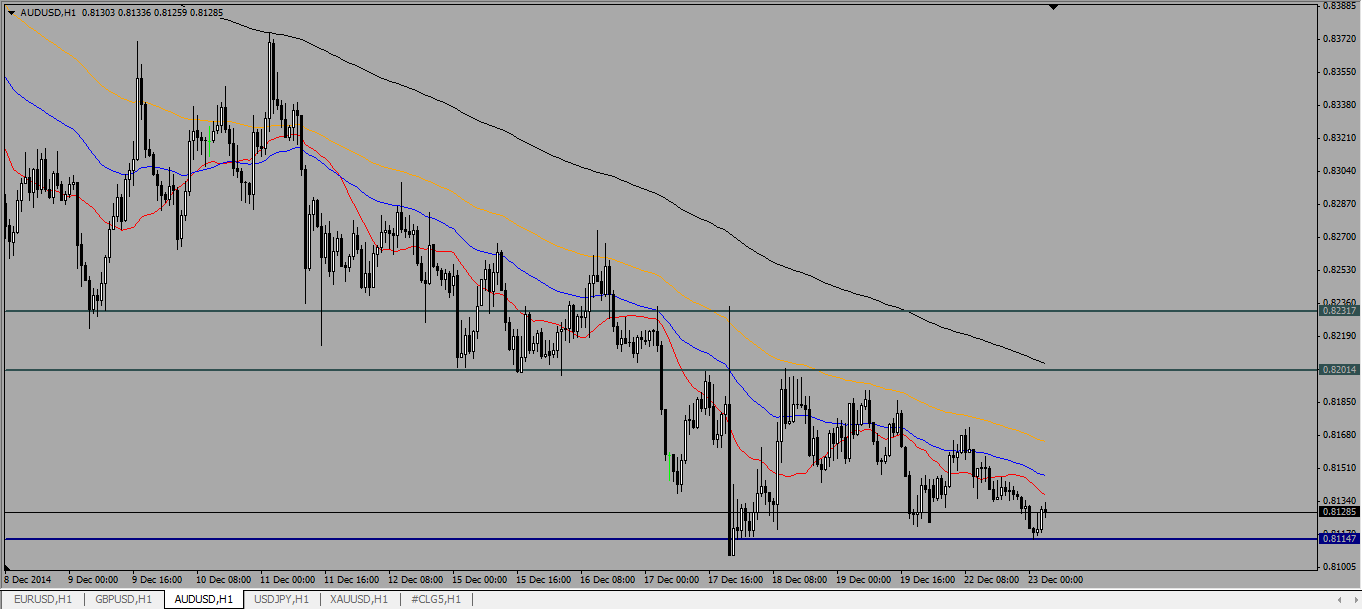

Observing H1 chart, although candles are supported at 0.8114, it is lower than the previous low at 0.8129, indicating that the bearish trend continues to hold.

Observing H1 chart, although candles are supported at 0.8114, it is lower than the previous low at 0.8129, indicating that the bearish trend continues to hold.

Trend Direction |

S3 |

S2 |

S1 |

R1 |

R2 |

R3 |

Entry |

Stop Loss |

Exit |

| Bearish | 0.7773 | 0.7941 | 0.8114 | 0.8201 | 0.8231 | 0.8282 |

Multibank Review

T&Cs apply, 18+

eToro Review

74% of retail investor accounts lose money

Capital.com Review

76% of retail CFD accounts lose money