Gold broke above the long-awaited channel late December 2016. Many traders begin to ask if the long term bullish trend has resumed. Based on this 17 January Gold Elliott wave analysis, we present the answers that have the highest likelihood. How do you take advantage of the Gold volatility?

17 January, AtoZForex - Prices of Gold have been on a downward move since July 2016. We discussed about a rally in our Gold analytics archive .We had our eyes set at 1100 and also stated that a break above the channel upside would mean a long term termination of the bearish drive. We would like to take you back to how we started with this analysis and what we expect in the coming weeks and months based on our 17 January Gold Elliott wave analysis.

17 January Gold Elliott wave analysis: weekly view

Weekly Gold Elliott wave analysis (click to zoom)

Weekly Gold Elliott wave analysis (click to zoom)

The chart above shows the weekly activities of price before 2006 till now-more than a decade. A 5-wave ensued and according to the Elliott wave theory, a 3-wave correction should follow. The 5-wave was an impulse wave and it completed in 2011. The first leg of the expected corrective move is an impulse wave also. This shows that the correction, when completed, is expected to be a zigzag pattern. The zigzag pattern is the only corrective pattern that starts with an impulse wave (or a leading diagonal). This impulsive wave (a) of the zigzag pattern ended with a diagonal pattern in December 2015 as shown in the chart below. A 3-wave move is expected upside for the second leg of the prospective zigzag corrective structure.

17 January Gold Elliott wave analysis: daily view

Daily Gold Elliott wave analysis (click to zoom)

Daily Gold Elliott wave analysis (click to zoom)

The chart above is the daily chart showing how price broke out of the diagonal early 2016 in a 5-wave bullish trend that continued till July/August of the same year. Since then price has been falling. The fall was the b-leg of the aforementioned zigzag of larger degree. How everything is falling into place!. This is a typical 'textbook' example of how the Elliott wave theory models the price movement of a financial instrument and speculates what will happen in the future. The last leg of this pattern is expected to go above 1400. By taking 100% of wave (a) from (b) on the weekly chart, there is 1458. We should be expecting Gold rally to continue to 1458. This is a vital information for position/long term traders.

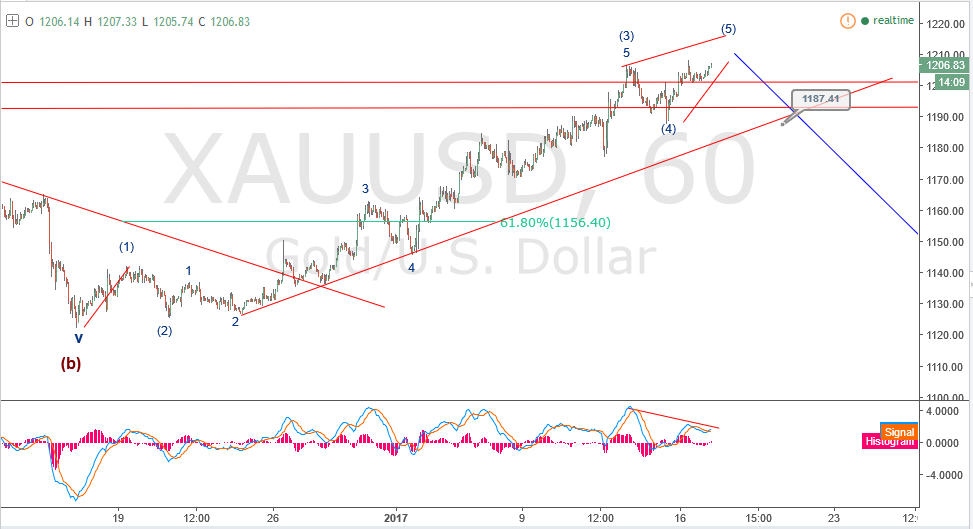

17 January Gold Elliott wave analysis: intraday view

A position trader may also look for a buying position at a lower price. Price moves in trends and corrections of larger and smaller degrees. The hourly chart above shows that price looks overbought.

Hourly Gold Elliott wave analysis (click to zoom)

Hourly Gold Elliott wave analysis (click to zoom)

A bearish correction will be seen as soon as current impulse wave is completed. The chart below gives a bigger look.

Hourly Gold Elliott wave analysis (click to zoom)

Hourly Gold Elliott wave analysis (click to zoom)

A bearish correction will be expected to 1156.40 or 1160 IF price breaks below 1187.4 and below the rising trendline. The 5th sub-wave is expected to be small (when the 3rd is extended, often time wave 1=wave 5). There is also a divergence on MACD. This could be a very good trade setup for short term traders. The long term traders can wait for a corrective dip and buy. This information could also be vital for a swing trader in a buying position. Until price breaks below the trendline, this bullish move has a good chance of continuity. Of course, price can move in few other ways but this seems to be the most likely based on Elliott wave theory. We will update you regularly at AtoZforex

Do you have other views in contrast to the ones listed or you want to compliment them further? let’s know by your comment below.

Don’t forget to share this analysis with people that matter to you.