The US dollar index (DXY) has staged a dramatic reversal since the start of last week. The DXY even has gained more than 5% from last Monday’s low.

19 March 2020 | HYCM – I took my normal constitutional walk yesterday after breakfast and was greeted by our new post-apocalyptic landscape. An eerie silence lingered in the air as there was a distinct lack of activity.

The end of the world as we know it, but the US dollar feels fine...

REM's song immediately sprung to me as I occasionally passed the odd dog walker who shuffled past me. He kept a good distance, of course, from the potential that I was a COVID-19 carrier. Welcome to our new coronavirus landscape.

And so returning to my terminal and more strange behavior, albeit financial in nature this time, I was reminded of the USD as the king of currencies when it comes to a big crisis. When it comes to the 'sell everything' landscape, the USD is the most liquid currency.

70% of all currency transactions involve the USD. It is little wonder that the USD is attracting more and more bids. I have been explaining this for a few days now to traders and yesterday the USD was bid with a vengeance.

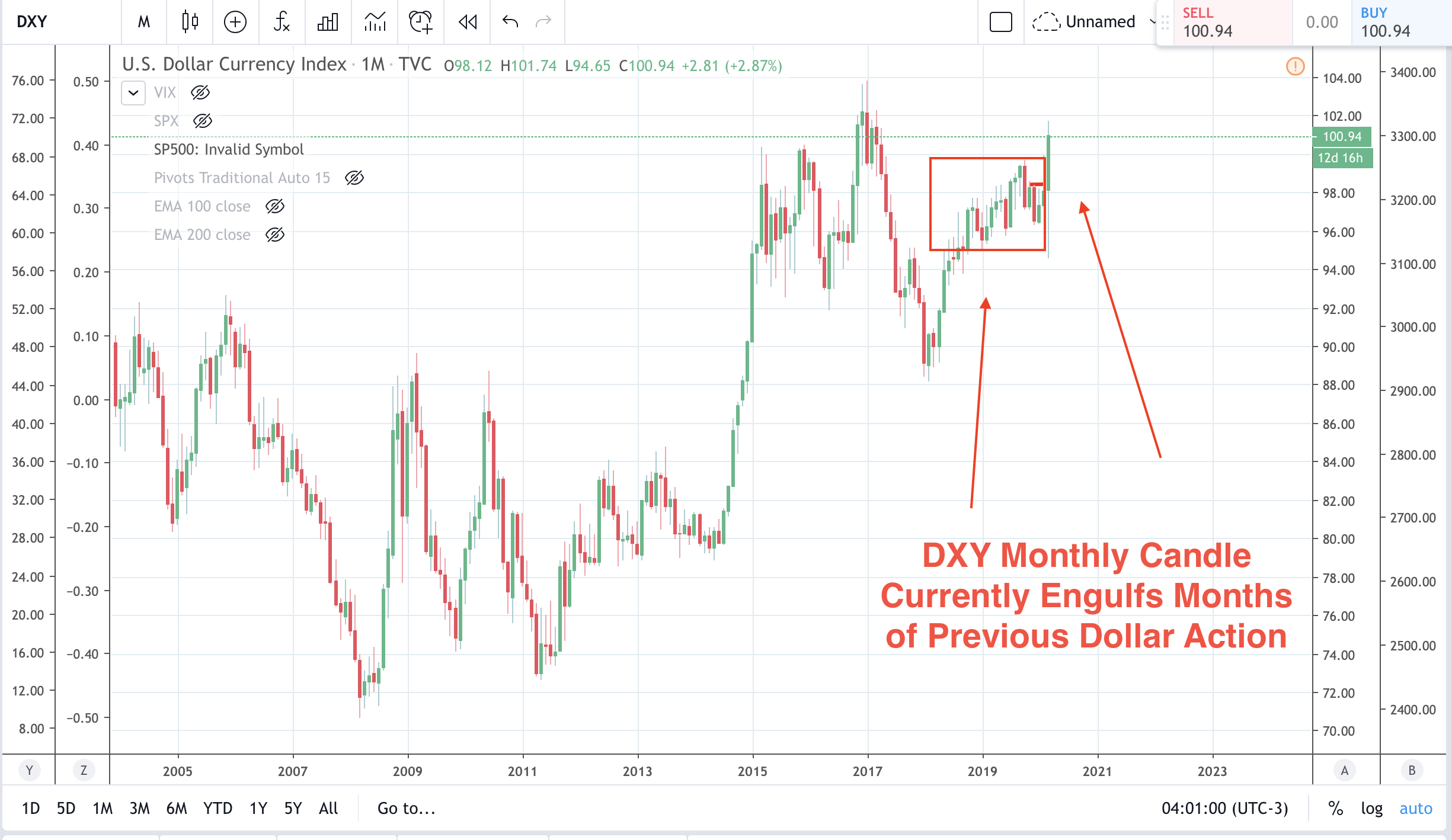

A look at the US dollar index (DXY)

The Dollar Index is showing it all. The current monthly candle is engulfing around 14 previous months of dollar action putting in a strong potential bullish Engulfing bar on the monthly chart.

For those who like to position trade, there is an excellent option here to buy the DXY and come back next month. That will give you plenty of time to plan how you will survive the coming isolation as we try to ride out the coronavirus storm. I hope to meet you on the other side.

Disclaimer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 58% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work. You should also consider whether you can afford to take the high risk of losing your money. For more information please refer to HYCM’s Risk Disclosure. Learn more about HYCM.

Multibank Review

T&Cs apply, 18+

eToro Review

74% of retail investor accounts lose money

Capital.com Review

76% of retail CFD accounts lose money