19 June, AtoZForex – Knowing how to follow the trend in Forex is often not enough. Even the strongest trending markets sometimes become reversed out of the blue. Therefore, knowing how to identify trend reversals and corrections increases your chances of success and allows to benefit from the market more. In this article, therefore, we will look into how to identify trend reversals.

Continuing from our previous trend following article, we will use the same two indicators and price action to spot trend reversals. These include two SMAs and moving average convergence divergence (MACD).

How to identify trend reversals in Forex

Just like determining a direction of a trend, trend reversals in Forex market are always determined and confirmed from a larger timeframe by looking at a bigger picture. Thus, we will only be concerned about weekly, daily, and hourly timeframes.

Identifying trend reversals with SMAs

The most commonly use moving averages are 20, 50, 100, and 200. Generally, two MAs per chart are enough, but depending on a strategy more or fewer could be used.

We need to look at three important aspects when analyzing a security using moving averages. Their crossover, slope, and price position relative to the SMAs.

Taking an example of 50 and 100 SMAs, a crossover of the two MAs could be seen as a bullish or bearish sign. While for 20 and 100 SMA combination, slope would be more important with primer indicating shorter term momentum and later projecting longer term momentum.

Identifying trend reversals with MACD

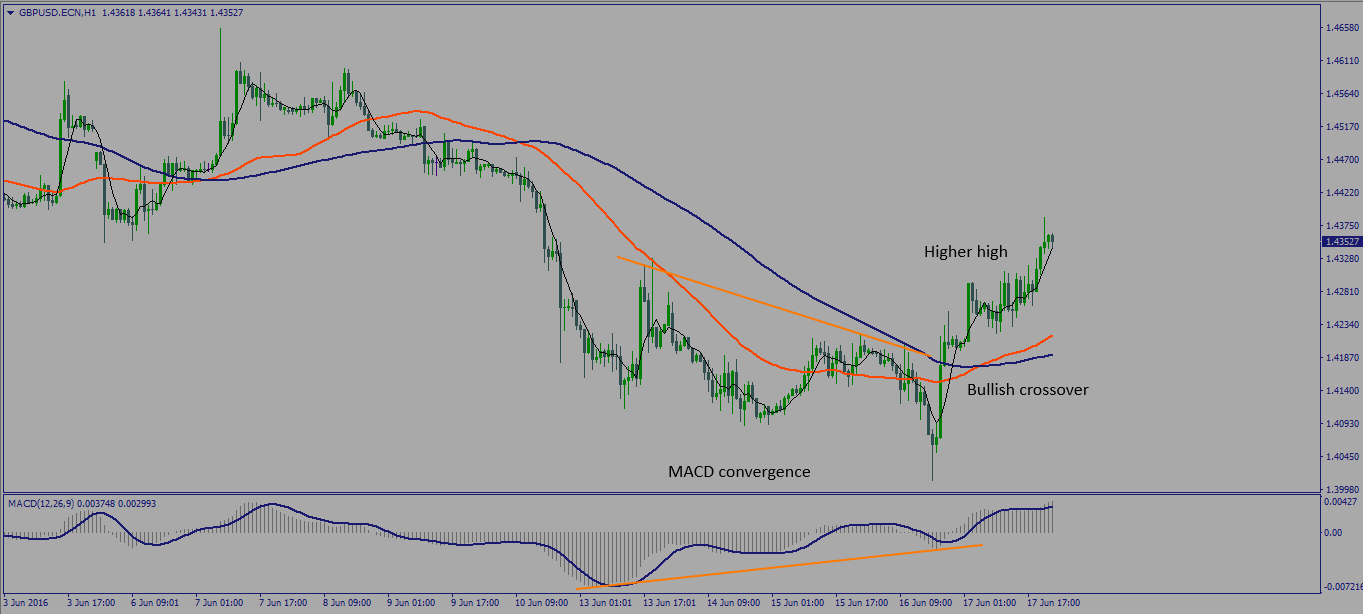

We talked about how, from weekly timeframe, an underlying trend can be determined by the position of MACD bars and confirmed by formation of bars relative to the trailing average. If the signals contradict, let’s say bars form at the top but below the moving average, this could be a sign of a correction wave.

Meanwhile, MACD and price action convergence/divergence warns of a possible upcoming shift in trend. Putting everything together, including price action analysis from the paragraph below, we can confirm a shift in trend.

GBPUSD H1, identifying trend reversals with MACD (click to zoom in)

GBPUSD H1, identifying trend reversals with MACD (click to zoom in)

Furthermore, applying methods of trend following, we can identify that this change in Cable trend is just a correction. Thus, we should be cautious with our long positions, and look for opportunities to short.

Identifying trend reversals with price action

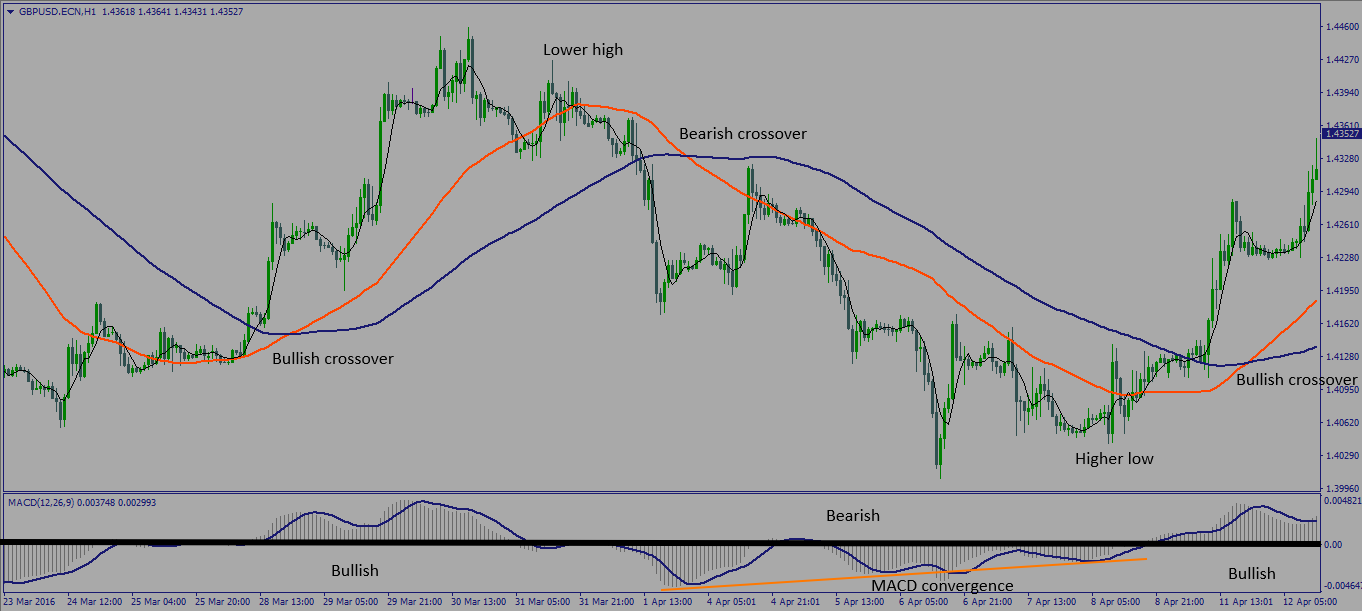

You might heard this many times, but the simplest way how to determine trend reversals is to spot breaks in formation of higher highs and higher lows in uptrend, and vice-versa in downtrend.

GBPUSD H1, identifying trend with price action (click to zoom in)

GBPUSD H1, identifying trend with price action (click to zoom in)

We have a nicely trending Cable at the picture above. Notice the formation of highs and lows? Unfortunately, it’s usually not that simple to identify the correct points, unlike the example above.

Putting all together

However, with experience and the help of indicators, this becomes easier.

GBPUSD H1, how to identify trend reversals in Forex (click to zoom in)

GBPUSD H1, how to identify trend reversals in Forex (click to zoom in)

Because indicators lag price action, they can be used as a confirmation for trend reversal or correction following a break of higher high and higher low formation in an uptrend. Putting all together, we have strong confirmation of change in trend.

Think we missed something? Let us know in the comments section below.