15 February, AtoZForex.com, London – Goldman Sachs has analysed the Swiss franc from A to Z, sharing their findings with currency investors and traders. The following is an indepth CHF outlook & targets.

Motivation for the FX View

Goldman Sachs expects the SNB to follow a reactive policy in relation to the ECB. Although the current low level of interest rates limits the room to ease further, more aggressive actions by the ECB will likely force the SNB to respond.

“We therefore forecast EURCHF to be essentially flat on a 12-month horizon,” Goldman Sachs noted.

Monetary Policy and FX Framework

The SNB targets economic inflation, with a cap on CPI set at less than 2% p.a. Since January 15th, 2015, when the Swiss Central Bank abandoned its peg for EURCHF at 1.20, the CHF is an effective managed float, where “opportunistic interventions” will continue to be the main policy tool for the SNB.

Growth Inflation Outlook

Swiss inflation has also become negative again due to the strengthening of the CHF. “We expect inflation to rebound to -0.1% in 2016 mostly on the back of base effects,” Goldman Sachs projected.

However, the underlying inflation dynamics should remain relatively weak. “We expect growth to rebound to 1.5% in 2016 from 0.8% in 2015 as the effect of the CHF appreciation shock wanes,” Goldman Sachs added.

Monetary Policy Forecast

Owing to its status as an open 'safe-haven' economy, the SNB's stance will remain highly sensitive to FX rate fluctuations. Absent a swift or persistent appreciation of the CHF, Goldman Sachs would expect the SNB to respond only to sufficiently aggressive monetary easing actions from other central banks.

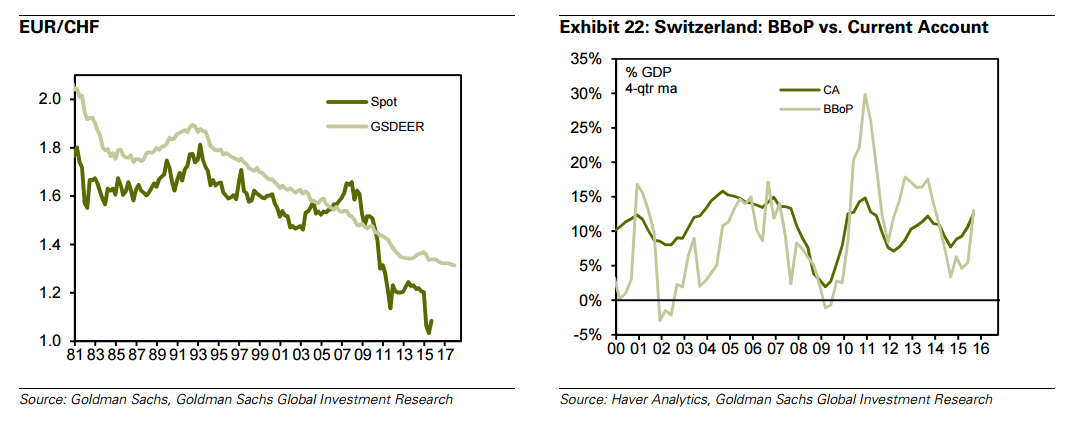

Balance of Payments Situation

The Swiss current account surplus remains strong, thanks to a surplus on all components. As a result, despite negative net FDI flows, the BBoP remains in surplus. Although, Switzerland’s portfolio flow data are complicated because of the country’s position as an international financial centre.

CHF Outlook

“We maintain our forecast for EURCHF of 1.09, 1.09 and 1.10 in 3, 6 and 12 months, respectively, which we adopted on December 7. This implies the USDCHF at 1.05, 1.09 and 1.16,” Goldman Sachs concluded.

Consider reading: UBS setups: Short USDJPY from 115

Think we missed something? Let us know in the comments section down below.