19 December, AtoZForex.com, London – Technical analysts at Bank of America Merrill Lynch and Nomura have shared their GBPUSD, gold and USDJPY technical analysis.

GBPAUD – Bank of America

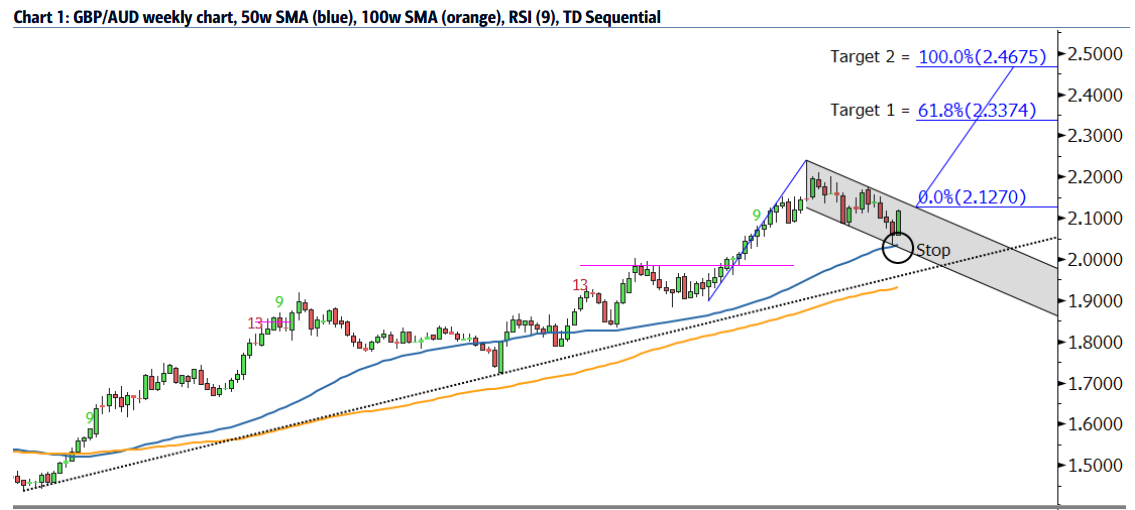

The upwards sloping trend in GBPAUD remains inatct as the pair has recently rallied of a support at the bottom of a small channel and the 50 week SMA. The price surge occurred when momentum fell to the most oversold level in 2015.

“We suspect price will break above the channel, creating a bullish flag pattern. Price pattern measurements estimate targets of 2.3374 and 2.4675,” Bank of America Merrill Lynch projected.

Multibank ReviewT&Cs apply, 18+

Multibank ReviewT&Cs apply, 18+ eToro Review74% of retail investor accounts lose money

eToro Review74% of retail investor accounts lose money Capital.com Review76% of retail CFD accounts lose money

Capital.com Review76% of retail CFD accounts lose money

Source: Bank of America Merrill Lynch

Source: Bank of America Merrill Lynch

Recommending to place a stop below the channel and 50 week SMA support at 2.025.

Gold – Nomura

Recently, the precious metal has been forming a bullish falling wedge near a major long term support at 1025 – 1000 area.

"This wedge is nearly complete but ideally we expect one more bounce and new low to satisfy this final 5th wave," Nomura noted.

Adding that this range between 1045 – 1090 area has been forming an a-b-c retracement, “we favour a move to 1090 now to complete the 3-wave pattern.”

As soon as the wave-B is formed, last leg in the wedge can be continued.

Meanwhile, Bank of America targets gold below 1000 level.

USDJPY – Nomura

Moving on to USDJPY, Nomura's view was for “wave-B/(2) rally to fail in 122.40/90 Fib zone”.

Nevertheless, the currency pair held below key 123.60 resistance and sharply reversed. Now the focus shifts on a resumption lower, first to 120.30 level," Nomura projects.

USDJPY H1 Timeframe, Gold and USDJPY technical analysis

USDJPY H1 Timeframe, Gold and USDJPY technical analysis

The next support area near 120.30 where old pivot line, an up-trend line and symmetry target align.

“A more aggressive extension target is 118.18 and this will come in to play sub 120.30. Near-term resistance is 121.60 and a break of 121.00 can usher the move lower to 120.30," Nomura added.

Consider: BNP Paribas BOJ review

Think we missed something? Let us know in the comments section below.