18 July, AtoZForex.com, Vilnius – Germany’s DAX index added additional 400 pips to its 1000 pip resile after three month fall.

Fundamentally, the further skyward move could be the consequence of investors finally seeing the end of Greece drama. As Greek authorities finally presented an acceptable, though it had to be corrected, plan to creditors on Thursday. However, uncertainty still exists, as the plan needs to be accepted by all European parliaments and fully implanted. Currently, France and Finland gave a green light for it, and Germany joined the allowing group on Friday.

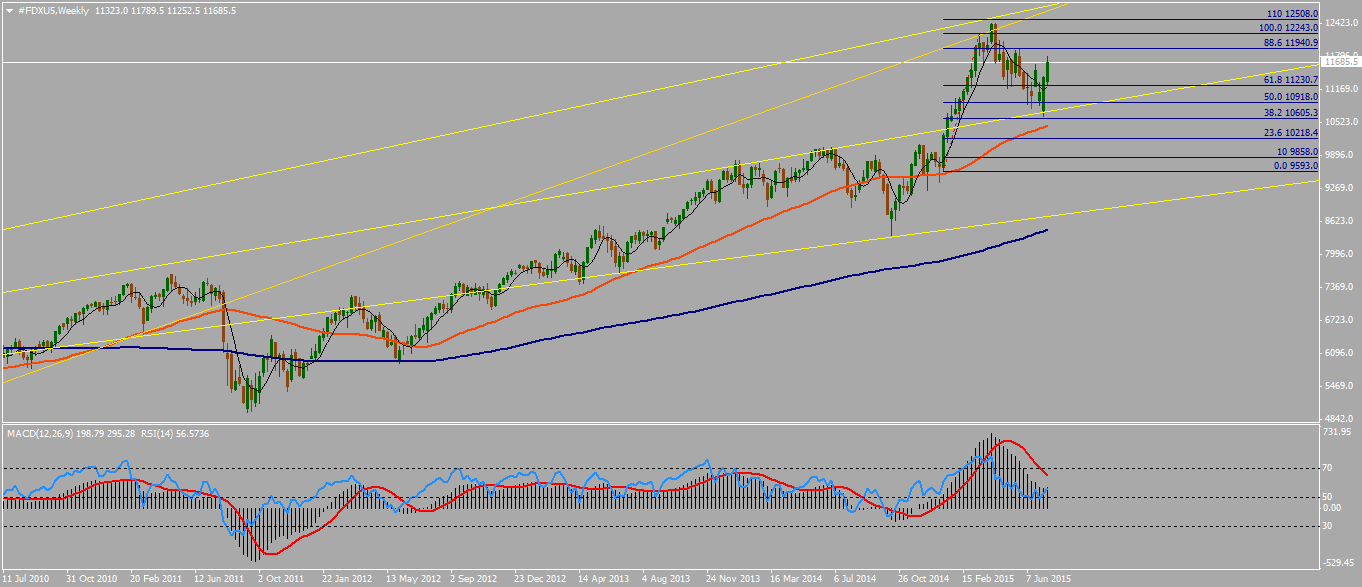

DAX Weekly Timeframe, 1000 pip bounced from Fibonacci Fan 50%

DAX Weekly Timeframe, 1000 pip bounced from Fibonacci Fan 50%

Moving on to a technical point of view, from weekly a time-frame, the 30 major German company index has bounced from Fibonacci Fan 50% and is now most likely aiming to a combination of monthly upward sloping trend line, Fibonacci Fan 38.2% and Fibonacci 123.6% retracement level at 12900.

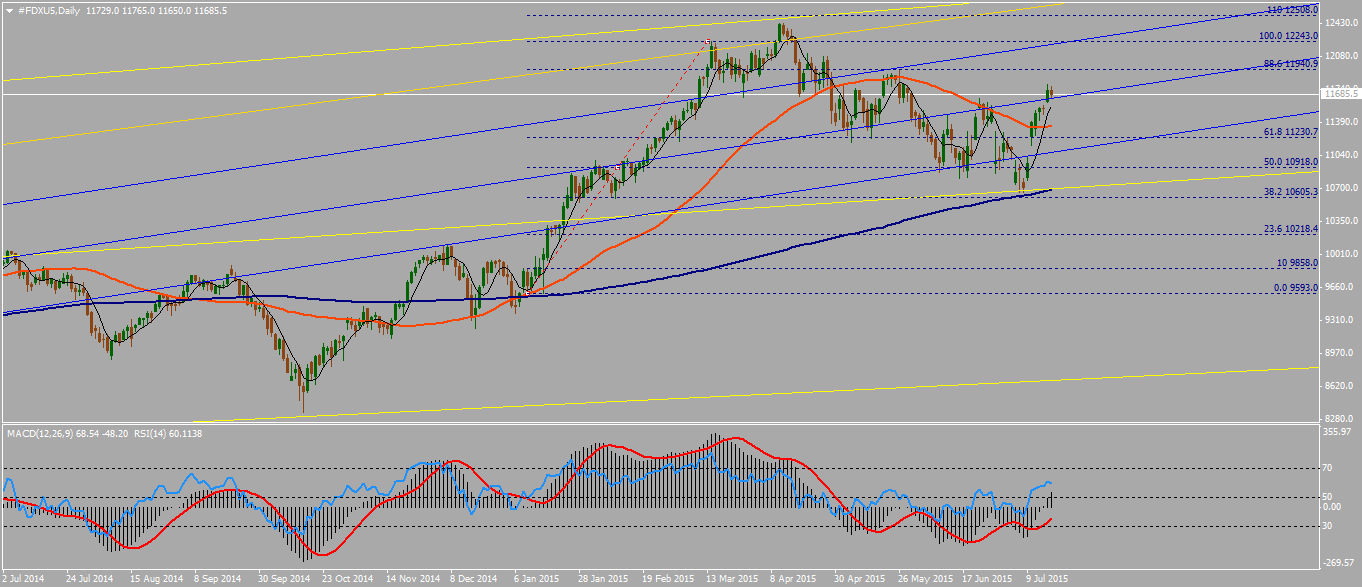

DAX Daily Timeframe, support and resistance levels

DAX Daily Timeframe, support and resistance levels

Looking at a daily time-frame, if we would to enter a long position at 11800 with a stop loss of 90 pips we could aim for a first take profit 140 pips away at Fibonacci 88.6% retracement 11941 level and then a second at Fibonacci 100% retracement zone at 12243.

Any short positions could be only considered from the mentioned Fibonacci levels after a confirmed bounce. The only major short position, at the moment, would be below a middle linear regression channel line approximately at 11600 with TP at Fibonacci 61.8% retracement level at 11231. Furthermore, price nearing any linear regression channel lines could provide additional scalping opportunities.

For GBPUSD outlook check