The article was updated on 12 November, 2019 by Amicus.

August 27, 2019 | AtoZ Markets - Leading cryptocurrency exchange, Binance has ventured into lending space. That is according to an announcement made yesterday.

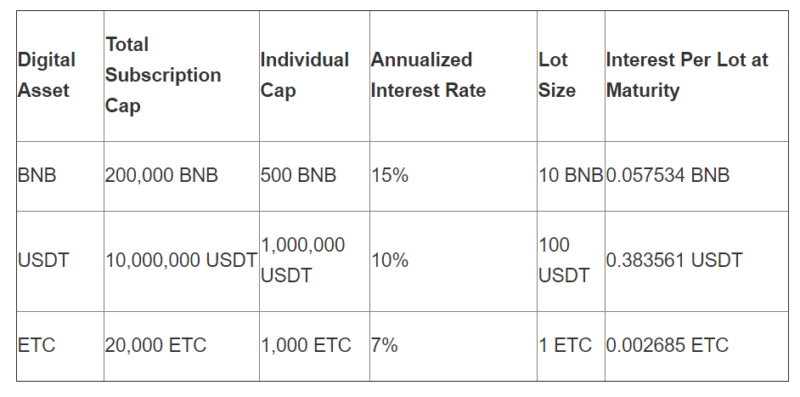

As detailed in a statement on its website, the new offering, dubbed “Binance Lending,” will allow holders of Binance Coin (BNB), Tether (USDT), and Ethereum Classic (ETC) stablecoin. That is for earning interest on their funds over two weeks. The Binance crypto lending service will be available on a first-come, first-served basis. It is starting from 6:00 am UTC on Aug. 28 to 12:00 am UTC on Aug. 29.

Binance crypto lending services offer interest-earning opportunities

According to Binance, the annualized interest rate for the initial BNB lending product has an initial 14-day fixed maturity term. It is set at 15%. The maximum cap per account is initially set at 500 BNB and 1,000,000 USDT, respectively.

Source: Binance

Binance users can decide the number of tokens. They want to lend at the time of subscription. And it will be able to retrieve funds with “guaranteed” interest after the designated subscription period, it added.

“Binance Lending is simple and intuitive to use. Users also can subscribe to any lending product and earn interest. Plus, it’s as easy as that. Besides, it guarantees the interest rate for each product. So your crypto balance will always grow, regardless of how the market moves,” said Changpeng Zhao “CZ,” CEO of Binance.

The new offering will “constantly” evaluate to add new coins and tokens based on demand and value, the exchange said. Yesterday, Binance also updated its “Lending FAQ” website page, by adding “Binance Lending Service Agreement". Moreover, it said that the new offering will be used in cryptocurrency leveraged borrowing business on Binance.com.

Crypto lending sector booms

The cryptocurrency lending sector is booming. Earlier this month, crypto credit assessment startup Graychain published a report. Moreover, it said that currently, the industry's value is at around $5 billion. However, lenders have earned back only $86 million (or 1.83 percent) in interest. Per the report, two lending players – Celsius and Genesis – have the highest volume with 65% of loan originations.

Last week, AtoZMarkets reported on the newly introduced Binance open blockchain project called "Venus," intending to develop localized stablecoins and digital assets pegged to fiat currencies across the globe. More recently, the company announced that it would offer a free, lifetime VIP membership account to all its affected users following the leak of its customer’s KYC (Know Your Customer) data.

Think we missed something? Let us know in the comments section below.