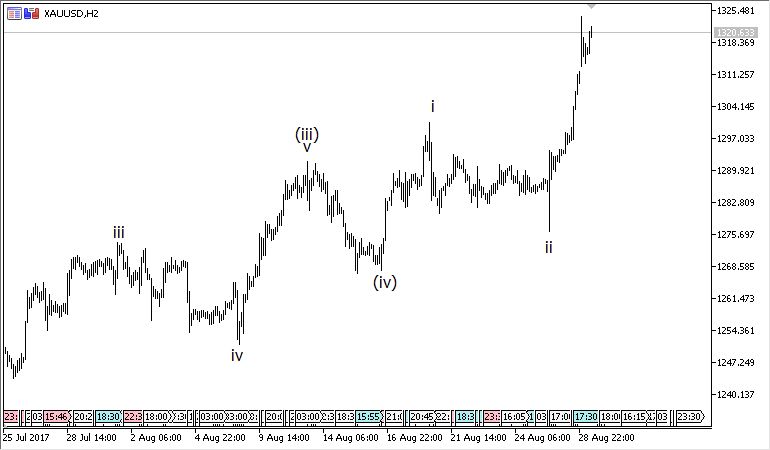

The bullish trend in Gold continue to get stronger as price rallied above the 1296 resistance and 1318.5 technical level. This article will show what we expect next based on 29 August Gold Elliott wave analysis.

29 August, AtoZForex - Our bullish bias gets stronger after price broke out of 1292 in the 18 August update. Price followed our preferred second scenario we had on 15 August update. It's phenomenal how we followed price and analyse the market from the most likely scenarios marking every condition to be satisfied. One scenario seems to be the 'exit point' for the other. It's a strong grip on the market with the Elliott wave theory. Our subsequent update expected an ending diagonal to halt the bullish momentum. Our bias is bullish until the diagonal is satisfied.

If the diagonal is satisfied, we will drop our bullish bias and look for the bears to take control for some days before the bulls resume. If the diagonal is violated, our bullish bias remain intact and non-violated. Let's review the last update. The chart below was used.

Gold Elliott wave analysis, H2 (click to zoom)

Gold Elliott wave analysis, H2 (click to zoom)

The impulse wave from 1204 is about to complete with a diagonal pattern. A breakout below the trendline connecting wave ii-iv should be broken downside to complete this setup. A strong break above 1306.76 will imperfect this setup. The bullish drive could end soon and price makes a bearish correction. If price moves as expected , a dip to 1240-1250 is very likely. Though long term trend is still bullish but we should expect a bearish correction.

The diagonal pattern was violated above 1306.76-1318.53 reversal zone thereby establishing the bullish strength even further. Let's see our next forecast.

29 August Gold Elliott wave analysis: what next?

Gold Elliott wave analysis, H2 (click to zoom)

Gold Elliott wave analysis, H2 (click to zoom)

This shows that the 5th wave still has a long way to go. The rally could continue to 1358. Stay tuned for the next update.

Do you have other views in contrast to the ones listed or you want to compliment them further? let’s know by your comment below.

Don’t forget to share this analysis with people that matter to you