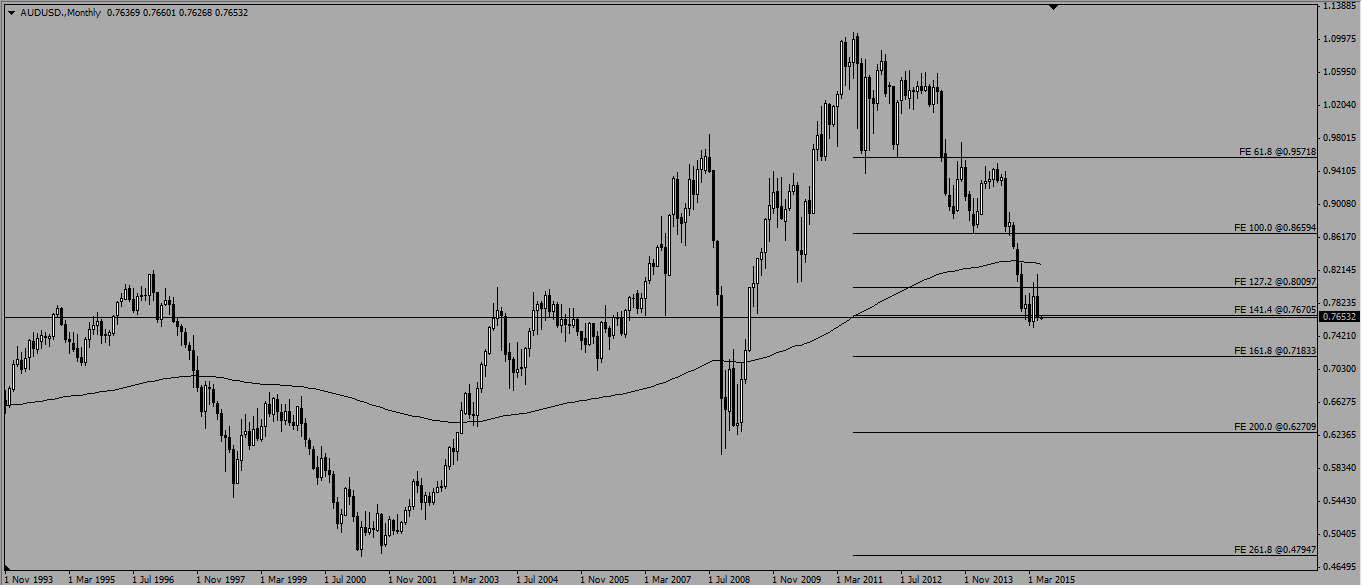

AUDUSD touches Fibonacci Expansion 141.4% at 0.7670 with candles now testing the support price for the second time. Candles continue to hold below the 200 EMA and have yet to show any clear indications of a reversal to the pair's current bearish run. Traders should take note of tomorrow's release of Australia's Cash Rate and another important factor that would set the trend direction for the pair would be this Friday's release of U.S Non-Farm Employment Change data. Should data released this week be bearish for the Aussie, we may see candles breaking below 0.7670 and head towards Fibonacci Expansion 161.8% at 0.7183 observed on the monthly chart.

Observing the weekly chart, candles continued on the second week of bearish run with candles now approaching Fibonacci Expansion 200.% at 0.7594. A double bottom formation may be formed and traders could possibly await to trade the reversal of the pair. However, traders have to take note that the current bearish momentum of the pair remains relatively strong and the various data releases this week could provide additional strength to the current bearish run.

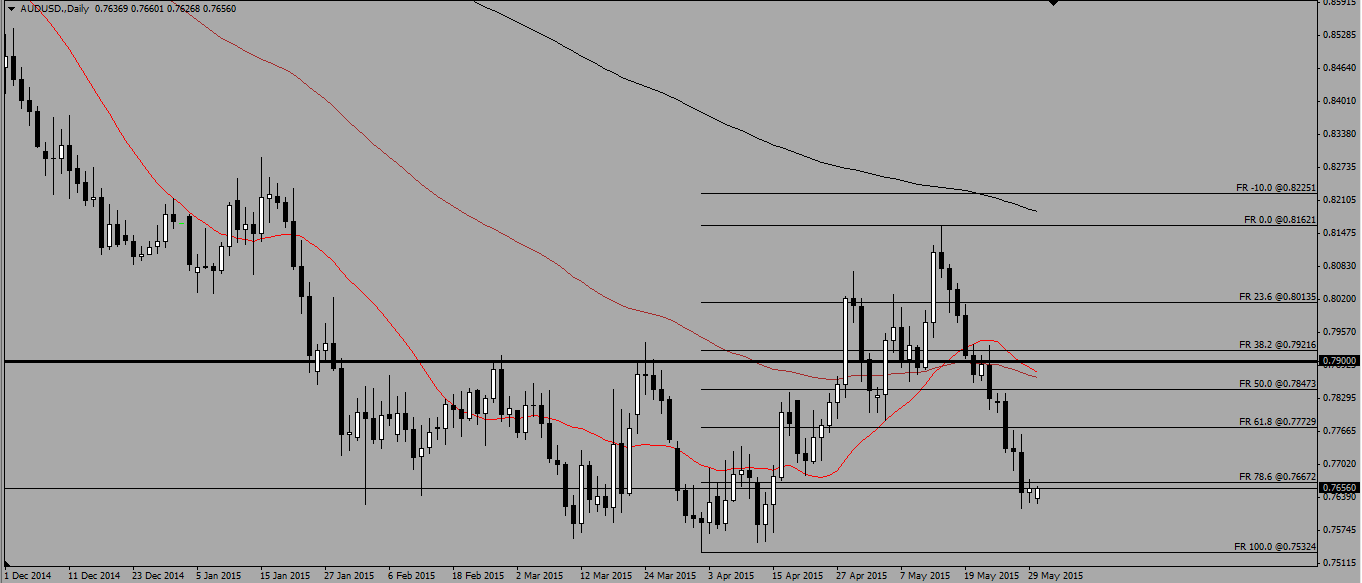

Focusing on the daily chart, candles now touch Fibonacci Retracement 78.6% at 0.7667 after last Friday's candle closed as a spinning top. There are no clear indications of a reversal yet and traders should be patient and await for entry signals. For cautious traders looking to engage in a swing trade, they could await for candles to continue falling slightly further towards levels of 0.75 which could happen either tomorrow or Friday with the release of U.S Non-Farm Employment Change data.