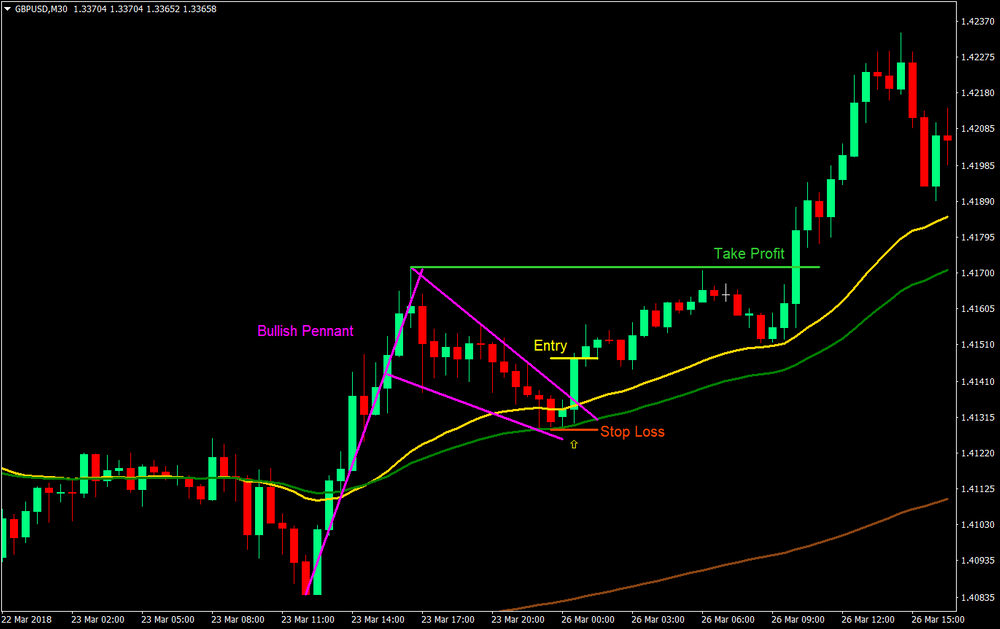

Flags and Pennants Forex Trading Strategy is aimed at improving our skills in identifying flag and pennant patterns, which we often miss on a naked chart. By adding the 30-50 EMAs, an area where we could anticipate these flags and pennants to take shape. If we spot one, then all we have to do is wait for the breakout, then enter the trade.

Moreover, the 200 EMA as a filter to identify the main long-term trend direction. By trading according to the direction of the main trend, we improve our chances knowing that we have lesser headwinds in front of us.

The 30 & 50 Exponential Moving Averages are great tools to help us identify these patterns. These EMAs are a pair of moving averages that work well as a support or resistance area. On a trending market environment, these are areas that we could expect the price to retrace to and then bounce back.

Given the above mentioned characteristic of these 2 EMAs, we could use them as dynamic support and resistance where we could expect retracements and contractions to occur during a trending market environment.

Timeframe: 15-minute chart and above

Currency Pair: any

Session: any

How to trade with Flags and Pennants Forex Trading Strategy?

Buy (Long) Trade Setup

Entry

- Price should be above the 200 EMA

- The 30 EMA (gold) should be above the 50 EMA (green), while both are above the 200 EMA (brown)

- A flag or a pennant should be identifiable

- Enter a buy market order on the close of the candle as soon as the resistance on the pattern is broken.

Stop Loss

- Set the stop loss at the minor swing low below the entry candle

Take Profit

- Set the take profit at the high on the thrust or pole of the pattern

Sell (Short) Trade Setup

Entry

- Price should be below the 200 EMA

- The 30 EMA (gold) should be below the 50 EMA (green), while both are below the 200 EMA (brown)

- A flag or a pennant should be identifiable

- Enter a sell market order on the close of the candle as soon as the support on the pattern is broken.

Stop Loss

- Set the stop loss at the minor swing high above the entry candle

Take Profit

- Set the take profit at the low on the thrust or pole of the pattern

Want to trade using Flags and Pennants startgey with a regulated broker? Open a free account with AtoZ Markets approved forex brokers:

How to download and install an indicator?

In order to install the indicator on your MT4 platform, you need to follow these steps:

- Click on “Download Indicator” button located at the bottom of the post.

- Save the file to your computer.

- Extract and move the files into MT4>Indicator folder of the MetaTrader4 software file directory.

- Restart your Metatrader platform.

- Navigate to “Indicators.”

- And select “Flags and Pennants Forex Trading Strategy” template to apply it on the chart.

Note: This indicator was developed by T. Morris. AtoZ Markets does not carry any copyrights over this trading tool.

Should you trade using Flags and Pennants startgey on your own at all?

Before you start trading with this Flags and Pennants startgey, you'll want to read this.

Our in-house trading expert Dr Yury Safronau, PhD in Economic Sciences, gives you daily his best forex, metals, and cryptocurrencies to buy and sell signals right now.

His trading strategies which are based on non-linear dynamic models have achieved more than 65 000 pips of profits since 2015. And right now there are some very strong buy and sell signals across several markets you don't want to miss.

Want to see which ones?